1 May, 2025 | Admin | No Comments

‘Cash is king’: UK shoppers fume over businesses that only accept card payment

When Covid forced the high street to go digital and turned handling physical money into a health risk, some businesses decided to stop accepting cash altogether.

As a result, cash use fell by 35% in 2020 alone, the steepest drop in a years-long downward trajectory.

Just 12% of all payments were made using cash in 2023, a figure that sat at 51% a decade earlier – and nowadays, ‘card only’ signs are a common sight.

But while many prefer the ease of contactless shopping, the Treasury Committee has warned that this trend could lead to a ‘two-tier society’ where vulnerable people are left behind.

According to its latest report, elderly people, disabled people, domestic abuse victims and those on low incomes are at risk of being excluded if the country transitions to a cashless economy.

Reduced consumer choice and ability to budget were also listed as potential impacts, with LINK research showing that half of respondents had been somewhere that did not accept or discouraged cash payments over the previous eight weeks.

While it stopped short of recommending a change in the law, it said ‘there may come a time in the future’ where cash acceptance is mandated, ‘if appropriate safeguards have not been implemented for those who need physical cash.’

Committee chair, Dame Meg Hillier, commented: ‘The Government is in the dark on how widely cash is being accepted and that is completely unsustainable… this needs to be a wake-up call.’

Metro readers thoughts on going cashless

On Facebook, Metro readers shared a number of concerns over the possibility of a cashless future, including Natalie Carter who commented: ‘Everyone loves cards, until there is a blackout or the banking apps go down. Then everyone cries about not being to pay bills. I say stick with cash – it can’t be manipulated the way digital can.’

‘Cash all the way, if you don’t use it you lose it,’ added Dawn Hughson, whileAlly wrote: ‘Cash is king! I always pay in cash.’

When it comes to shared the places where ‘card only’ policies irk them most, car parks were a common theme.

Sharon Woodward was among those who bemoaned trying to pay for parking with no signal and dodgy apps or card machines that time themselves out.

Lorraine Close said she’d ‘hate to be stuck to using card only at the pub’ as ‘it’s impossible to over spend if you take your limit in cash’, while according to Lorraine Stocks, the ability to pay with cash at Center Parcs would help it be ‘an inclusive place for everyone’.

Jo Sturch said she’s decided to boycott Gail’s for her coffees after forgetting they don’t take cash, but Kristen Stephanie Roobottom claims it’s most annoying at theme parks ‘when you have little ones with pennies to spend on a treat’ since ‘it doesn’t feel the same with pocket money just paying on a card.’

Cashless refreshments trolleys on planes were another common gripe, with Barbara Ibbett claiming her Barclays bank cards ‘don’t seem to work on EasyJet, leaving her without an in-flight snack.

Is it legal for retailers to refuse cash?

Although cash is considered ‘legal tender’, this only means it can’t be refused as payment for a court-ordered debt.

The Treasury explains: ‘The acceptance of physical currency in the UK is not currently specified in legislation. Businesses and organisations can therefore choose which payment methods they accept.’

If a retailer specifies card payment only and you’d prefer to use cash, unfortunately your only option at present is to take your business elsewhere.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

An iconic pottery firm has gone bust after more than 100 years of trading.

Moorcroft Pottery, based in Stoke-on-Trent at the heart of the UK’s pottery region, has shut with immediate effect, putting 57 people out of work.

Directors had warned of job cuts in March and worked to find a buyer in the weeks leading to the closure.

Bosses said in a statement: ‘The company faces an increase in energy and other costs, in a difficult trading environment with a global cost of living crisis. This has resulted in a seemingly unsustainable financial position.

‘The board of directors wishes to thank each employee for their unique heritage skills and commitment to the art pottery during a very challenging economic period.

‘The directors have pursued every avenue possible to save the business, however they have been left with no other option than to engage the services of a local insolvency firm to place the company into liquidation.’

Union organiser Chris Hoof told Metro: ‘The closure of Moorcroft is devastating news for workers and their families, but, unfortunately, it’s not a surprise.

‘The government must act and act now to support the ceramics sector and protect workers in this sector.’

Moorcroft was founded in 1897 and by 1928 it was appointed as Potter to HM The Queen during the reign of George V and Mary.

Queen Elizabeth II added Moorcroft designs into the Royal Collection and the company won many prestigious international awards.

Reflecting on the collapse of Moorcroft, a spokesman from the British Ceramic Confederation said: ‘This regrettable news underscores the significant challenges currently facing the UK ceramics sector, including soaring energy costs, increased international competition, and a difficult trading environment.

‘These pressures are making it increasingly difficult for even established and celebrated manufacturers to remain viable.

‘Ceramics UK is actively engaging with the government and relevant stakeholders to highlight the urgent need for support for our vital industry.’

Rise and fall of an industry

The pottery industry in Stoke traces its roots back to the mid-17th century, thanks to an abundance of clay.

There was a boom in the yearly 1700s and by World War Two, half the town’s population was employed in the industry.

However, over recent decades, there has been significant decline with the closures of Dudson in 2019, Wade in 2023, Johnsons Tiles in 2024, and Royal Stafford in February.

The collapse of the industry has been put down to:

- the rise of mass production

- not enough people with the right skills

- Lack of support for small business

Despite the bleak outlook for the industry, Stoke-on-Trent retains its status as the World Capital of Ceramics.

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.

30 Apr, 2025 | Admin | No Comments

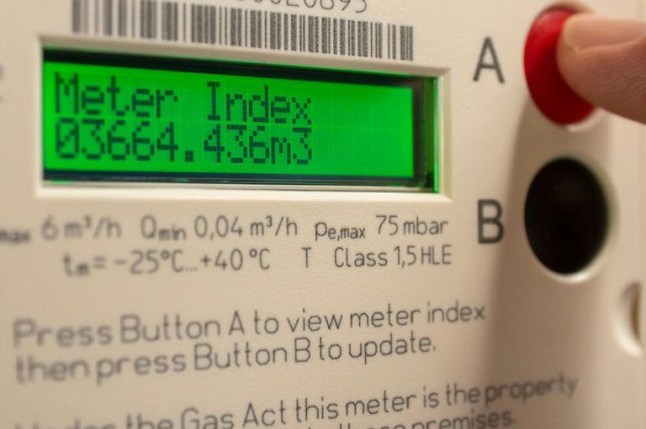

Electric meters are changing – here’s how it affects you and what you need to do

Hundreds of thousands of people could be left with no heating or hot water as their obsolete electricity meters are shut down.

Radio Teleswitching Systems (RTS) are being switched off for good on June 30 – but energy companies warn it will be ‘very very difficult’ to replace all of them with smart meters before that deadline.

By the end of March there were still 430,000 homes using RTS meters for their heating and hot water, and campaigners reckon more than 300,000 will still be stuck with the old tech when it’s switched off.

Energy UK, which represents energy companies, says more than 1,000 RTS meters are being replaced each day – but in order to reach everyone in time they would need to replace closer to 5,000 per day.

And not only could homes be left with no heating or hot water, there are also concerns they could be stuck with their heating constantly on during the warmer summer months.

Ofgem, the energy regulator, has called it an ‘urgent consumer welfare issue’ while the government said the industry has to ‘work urgently to continue to increase the pace of replacements’.

When asked if it was impossible to switch every meter by the June 30 deadline, Ned Hammond, Energy UK’s deputy director for customers, told the BBC: ‘I wouldn’t want to say impossible – but clearly very, very difficult to get to that point.’

RTS meters have been used since the 1980s, using a longwave radio frequency to switch between peak and off peak rates.

They tend to control heating and hot water on a separate circuit to the rest of the household’s electrics, meaning plug sockets and lights are unlikely to be impacted by the switch-off.

The deadline for the switch-off was originally set for March 2024, but it was extended by more than a year to give energy companies more time.

How do I know if I have an RTS meter?

According to the Energy Saving Trust, you might have an RTS meter if you:

- Live in a house with no gas connection

- Use electric heating to heat your home

- Have a tariff where the price of electricity changes at different times of day

- Have a separate box near your electricity meter with the words ‘radio teleswitch’ or ‘radio telemeter

- You have two codes on your electricity bill that start with the letter S. These are ‘supply numbers’ or ‘S numbers’

What happens if my RTS meter isn’t changed by the deadline?

If your supplier doesn’t replace your meter by June 30, your heating and hot water will likely be affected. They might:

- Stay on all the time

- Not come on at all

- Charge at the wrong time of day

- Turn on and off at odd times of day

- Not come on when you want them to

You might see your energy bills go up as a result.

Ned said energy companies are still aiming for the June 30 deadline ‘as things stand’, and say they are developing plans for a ‘managed and very careful phase down of the system’ to try and protect vulnerable customers.

Simon Francis, from the End Fuel Poverty Coalition, said: ‘With pressures on the replacement programme growing and with limited engineer availability, especially in rural areas, there’s a real risk of prolonged disruption, particularly for vulnerable households.’

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.

Having gained over 107,000 signatures, Metro and the family support charity Feed delivered their Formula for Change petition to the Prime Minister Keir Starmer and Secretary of State for Health and Social Care Wes Streeting today, to demand more is done to make infant formula accessible and affordable to all families.

Launched in 2023, our award-winning campaign has continued to raise awareness of the impact of soaring formula prices, which have rocketed by 25% in the past two years.

Under current guidelines, formula falls into the same category as tobacco and lottery items, and isn’t available to purchase with cash alternatives. However, without loyalty points and grocery vouchers provided by local councils and food banks to those struggling the most, parents at the sharpest end of the cost-of-living crisis have few options.

Some families are even being forced into unsafe infant feeding practices that put their babies’ health at risk, while others are formula foraging, or stealing formula to feed their children.

This is why the Formula for Change petition is urgently calling on the UK Government to review infant formula legislation and give retailers a clear green light to accept loyalty points, grocery vouchers provided by food banks and local authorities, and store gift cards as payment for infant formula.

While we know this measure alone won’t solve the problem, it will increase options for families.

To view this video please enable JavaScript, and consider upgrading to a web

browser that

supports HTML5

video

The Westminster visit follows the Competition and Markets Authority’s recommendations that vouchers and loyalty points should be allowed when buying infant formula.Despite the CMA’s suggestion, the government has yet to comment on the issue.

When a petition exceeds 100,000, it is considered for debate in Parliament, and today’s milestone achievement saw key figures in the campaign’s success visit No.10 to hand-deliver the document.

Metro deputy editor Claie Wilson, journalist Kat Romero and founder of Feed Dr Erin Williams headed to No. 10 with Blackpool South MP Chris Webb and celebrity supporters LadBaby’s Mark Hoyle and wife Roxanne, who have been instrumental in the campaign by garnering support across their social media platforms and sharing their own experiences of food poverty.

Outside No. 10, Mark told Metro: ‘We’re hoping this is going to make such a huge difference to so many families in the UK.’

Roxanne added: ‘We wanted to be involved in the campaign because Mark and I meet parents who have cried at the checkout because they haven’t been able to use their vouchers to get formula.

‘It’s really important we’re not judging families. Every baby deserves to be fed.’

Metro’s Claie said: ‘I am so proud of the work we have done to raise awareness of the formula crisis in the UK and also so pleased to see so many others share their support and help make change.

‘Now we just need the government to do their bit. Last year, Wes Streeting promised to “get it done”, yet we’re still waiting, and families are still struggling. It is time to follow through on their pledge to help formula feeding parents.’

Kat said: ‘Over two years ago, I pitched a feature to Claie about a government policy that prohibited the discount of infant formula and how it was impacting families in a cost-of-living crisis.

‘Through that piece, I met Erin and the idea to launch this as a campaign was born. In the two years since, Formula For Change has achieved more than any of us involved could have imagined and today, we were invited to Downing Street to formally deliver our petition of over 100,000 signatures. Change is coming. What a day.’

Erin expressed how proud she was of how far the campaign has come in two years, but also admitted that there was still work to be done. Desperate parents have been reduced to watering down formula and even stealing tubs off shop shelves to ensure their babies get fed.

‘We’ve had great success in bringing down the prices of formula across the board, so families can still feed their children when money is tight,’ Erin told Metro.

‘We’re under no illusion that this will solve all the problems, but little actions can have big consequences.

‘We don’t need to change any laws or have big debates; change can be done without that, and it can be done quickly.’

Chris also joined the campaign team to deliver the petition, after recently raising the issue in the House of Commons and holding a drop-in event at Westminster to highlight the campaign to fellow MPs.

He said: ‘Today really puts into focus how much support this campaign has gathered across the UK, from normal working-class people to celebrities. It’s great to be able to hand that over to make sure their voices are all heard.’

Speaking about his personal reason for wanting to be involved, Chris explained: ‘When I had my son last year, I went to baby groups. I saw mums struggling, asking for tubs of formula, and the same at food banks.There are babies that are going hungry. Families need help.

‘I looked for campaigns that were trying to provide this, and I found Formula for Change, so I reached out and have done what I can from my part.

‘We’re heading in the right direction and we won’t stop until formula is accessible to all.’

Further Formula For Change supporters came to Parliament Square to share the moment, including director Naomi Waring, whose short film about the formula crisis, Milk, was produced by Sienna Miller. Founders of baby banks The Space, Little Village and Abernecessities, and Change Box also attended.

Since its launch, there have been many wins for the Formula for Change campaign. Iceland was the first high street retailer to allow loyalty vouchers and gift cards to purchase baby formula. They also took the lead in providing clear labelling on baby formula to inform parents that all first infant formulas are nutritionally equivalent, regardless of brand or price.

Richard Walker, Executive Chairman of Iceland Foods said: ‘Formula for Change truly is a life-changing campaign for thousands of parents, and I’ve been so proud that we have supported its efforts as a business.

‘The work conducted by the team at Metro and Feed has been astonishing, and I fully support the petition they have delivered to No.10 today. It’s vital that the Government supports the CMA’s recommendations so we can make the formula affordable and accessible for all.’

Morrison’s has also gone on to allow other forms of payment for infant formula, while the Department of Health and Social Care officially confirmed that food and baby banks can supply cash-strapped families with formula tubs.

Since 2023, the campaign has received the backing of several MPs, including Monica Lennon, Preet Kaur Gill and celebrities Katherine Ryan, Ashley James and Michelle Heaton are among the famous faces who have voiced their support.

The campaign has also been given the prestigious Making a Difference award, which was voted for by the public, acknowledging Formula For Change’s drive for change.

Do you have a story you’d like to share? Get in touch by emailing Josie.Copson@metro.co.uk

Share your views in the comments below.

If there’s one thing I know to be true about Lidl, it’s that the supermarket’s in-store bakery has a cult following.

Seriously, people are obsessed with everything from the retailer’s All Butter Croissant – with 122 of them selling every single minute – to the chocolate twists and the bread.

And there’s good news if you are part of the fan club, as it’s just been announced that Lidl is slicing its bakery prices, with some items now selling for just 29p each.

Customers will be able to purchase a Petit Pain or White Crusty Roll for 29p (previously 32p), while the beloved croissant will be going from 65p to 59p.

Other items included in the price drop are the All Butter Pain Au Chocolate, Pain Aux Raisin, Chocolate Twist, Chocolate Hazelnut Croissant, Almond Croissant, Maple and Pecan Plait and the Pastel de Nata.

All of these baked goods were originally 79p, but will have a new price of 69p.

A new Apple Turnover is also going to be just 69p when it launches in-store on April 25.

It’s not clear how long this roll back of prices will last for, so if you’re a pastry lover you might want to enjoy the savings while you can.

This comes after Lidl launched several new bakery items over Easter, including a Mini Egg Brownie, Cinnamon Bun Blondie, and a Brioche Chocolate Croissant.

And the retailer also recently unveiled plans for its first-ever in-store supermarket pub.

The £410,000 boozer will be located in a store in Dundonald, just outside Belfast, on the left side of the existing supermarket, at the opposite end of the store from the entrance.

According to drawings submitted to local planning officials, there will be six seats around the main bar, with 10 other tables/seating areas dotted around inside.

A lobby area, keg room, storage space with an ice machine, chill store, and office, with three toilets – a customer WC, an accessible unisex toilet and one for staff use only – are planned too.

The pub will also have an ‘off-sales’ area where customers can buy alcohol to consume off the premises, and an entrance/exit leading to the car park.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

24 Apr, 2025 | Admin | No Comments

Nationwide shares major update on £100 customer bonus payout date

If you bank with Nationwide, you could be due a windfall in the next few months — a welcome prospect for those in need of a cash boost.

The building society operates as a mutual rather than a traditional bank, meaning it’s owned by and run for the benefit of its members.

As such, Nationwide shares profits among account holders (rather than shareholders) as part of its Fairer Share Payment initiative, with almost 4 million customers nabbing a £100 bonus last summer.

‘The Fairer Share Payment is our way of rewarding those members who choose us for their everyday banking as well as having savings or a mortgage with us,’ the bank said in a statement.

The exact details of Nationwide’s next one-off payout have yet to be revealed, but recently announcement offers a major update on the timeline.

And ahead of the Board’s official decision, last year’s eligibility criteria gives us an idea of what to expect this time around.

When will the Nationwide bonus be paid out?

The bank’s financial results are due to be shared with the public on Thursday May 29, along with an announcement on the Fairer Share Payment.

A Nationwide spokesperson tells Metro: ‘Nationwide’s Board will decide on a Fairer Share payment for 2025 and it will depend on our financial performance.

‘That assessment will be made after our financial year end, with the eligibility criteria for this year being agreed then too. The decision will be announced as part of our full year results in May.’

Last year, bonuses were deposited into members’ accounts between June 13 and June 28, so if the scheme does go ahead – which Martin Lewis’s Money Saving Expert said is a ‘likely’ outcome – you’ll probably have a few months to wait before you receive any cash.

However, all the hard work was done for customers in previous payouts, so you shouldn’t need to make a claim or request the money yourself.

If it’s confirmed and you think you qualify but haven’t heard anything from Nationwide by June, get in touch. And don’t forget to stay aware of fraudulent attempts at obtaining your personal information to apply for the payment.

Who is eligible for the Nationwide bonus?

Assuming the scheme comes with the same prerequisites as it did for 2023-2024, to be in the running, customers must hold both a qualifying current account as well as a qualifying savings or mortgage account.

Each of the bank’s current accounts were eligible, providing certain criteria are met.

The first of these is that the account was open on March 31, the end of the financial year — although those who switched accounts between January 1 and March 31 were exempt from any additional requirements.

Otherwise, Nationwide explained that FlexAccount, FlexDirect or FlexBasic holders must have either received £500, made two payments from their account, or completed at least 10 payments out of the account between January and March to qualify.

Meanwhile, FlexPlus account holders must have paid their monthly fee, and FlexOne, FlexStudent or FlexGraduate customers need to have made at least one payment in or out during March.

Those with investment accounts and stocks and shares weren’t included in the criteria, but savings account holders qualified if they had a minimum of £100 in total across Nationwide personal savings accounts or cash ISAs at the end of any day in March.

When it came to mortgages, customers must have owed at least £100 on their residential mortgage with the building society on March 31.

Home loans through subsidiaries such as The Mortgage Works, UCB Home Loans Corporation Limited, or Derbyshire Home Loans Limited are excluded from the bonus, as are commercial mortgages and those not completed by March 31.

If you’re not sure whether you fit the bill, you can use Nationwide’s eligibility checker to work it out (although be aware this criteria may change for 2025).

A version of this article was first published on December 12, 2024.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

22 Apr, 2025 | Admin | No Comments

Mum-of-two took own life ‘after mortgage payments shot up by £500 a month’

A mum-of-two killed herself after her mortgage payments rose by £500 a month and her application for benefits was turned down, her daughter has said.

Kathleen Moore, 60, spent the last four years struggling to make her payments after they shot up due to rising interest rates on her interest only loan.

She had osteoporosis, which hindered how much she could work as a dog sitter, and she was too young to retire and receive her pension.

Kathleen applied for personal independence payment (PIP) and universal credit but was told she didn’t meet the criteria due to her age and the fact she had a mortgage.

Daughter Amy Evans, 37, said her mum tried to work at least 30 hours a month and rented out rooms in her home to try and make the mortgage payments but still had to rely on foodbanks.

Amy said her mum would often talk about was her money problems but didn’t let on how bad it was.

She said she was ‘devastated’ when she got the call to say she had taken her own life in August 2024.

Now she is petitioning to see more financial and mental health support for those over 60 – including a review into the eligibility criteria for Universal Credit and PIP.

Amy, a cleaner, from Lowestoft, Suffolk, said: ‘She’d talk about money so much.

‘It consumed her – the worry – for such a resilient person.

‘She wasn’t entitled to universal credit because she had a mortgage. She wasn’t poorly enough for PIP. Everywhere she turned there were no answers.

‘If someone had helped – she’d still be here.’

Amy said she noticed her mum started stressing about money after becoming single four years ago.

She said: ‘She was with her partner for 10 years and they went their separate ways. It made it difficult for my mum financially.

‘The interest rates went up. I think her mortgage went up from £100 to £600-a-month.’

Amy said she offered to let her mum stay with her if she needed to, but described how she was ‘proud’ and wanted to stay in her own home.

Amy said: ‘It took a lot for her to ask for help – I think she was ashamed.’

She said the family did not realise how bad things were because whenever things seemed to ‘dip’ she always appeared to ‘get back on her feet’.

That realisation came crashing down when Amy got the call on August 15 last year to say her mum had ended her life.

Amy said: ‘It wasn’t really until she’d gone that we looked at all the paperwork and saw how desperate she’d become.

‘She could never really make ends meet. She got desperate and bought into loan sharks. She was so worried all the time about having a roof over her head.’

Now Amy is calling for a review into the eligibility criteria for universal credit and personal independence payment (PIP) to ensure individuals aged 60 and over who are self-employed, carers, or single without dependents are no longer ‘unfairly’ excluded from vital financial support.

She also wants to see a dedicated mental health counselling service for those aged 60 and over.

Amy said: ‘She needed a financial solution. Someone to talk to could have changed what she was planning.’

Paying tribute to her mum, she recalled how she ‘was the life and soul of most parties when she was younger’ and ‘was very resilient’.

‘I hope the petition will save someone else,’ she added.

Amy’s petition can be found here.

Need support?

For emotional support, you can call the Samaritans 24-hour helpline on 116 123, email jo@samaritans.org, visit a Samaritans branch in person or go to the Samaritans website.

Their HOPELINE247 is open every day of the year, 24 hours a day. You can call 0800 068 4141, text 88247 or email: pat@papyrus-uk.org.

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.

Ask any parent, and they will tell you that having children is an expensive business. However, it turns out some mums and dads spend vast sums on items their kids don’t need or want.

UK parents collectively waste a staggering £7billion on items for children that just don’t get used, according to data published by iCandy.

For context, that would be enough to give every single user on Facebook about £5 each.

Nearly 60% of parents admitted to buying items that were either never used or used less than twice in the first 12 months, wasting an average of £379 each.

57% of the parents surveyed retrospectively said they had bought too much stuff for their baby, and 46% admitted to regretting doing so.

Perhaps unsurprisingly, cuddly toys were found to have topped the list of unused items – the adorable faces of plush animals can sometimes be hard to say no to in the store, and we all know that kids can be particularly choosy with what they actually take to.

Outgrown clothing and shoes are also high on the list, neither of which will be particularly surprising, with your little uns’ sometimes growing at what seems like lightning speed.

However, some of the items parents ended up not using may raise an eyebrow.

A staggering 28% of the parents surveyed confessed to never having used some of their baby towels – an item you’d think you could never have enough of! – with bath supports or seats also coming in 5th on the list.

Hardly an impulse purchase!

What do parents waste money on

Out of the over 1,000 parents with kids under 10 that iCandy spoke to, the baby items they confessed to never having used were as follows:

- Cuddly toys – 30%

- Baby towels – 28%

- Baby shoes – 25%

- Clothes that were outgrown before they could be worn – 25%

- Bath support/seat – 21%

- Baby walker – 20%

- Bath thermometer – 19%

- Nappy bin/genie – 19%

- Breast pump – 18%

- Baby sling – 17%

- Fiddly/fancy outfits with buttons/layers etc – 16%

- Baby food blender – 15%

Source: iCandy

How to cut down on costs as a new parent

As a new parent, being more judicious with your spending on some of the items above can help you avoid the potential for this almost £400 mistake.

However, there are other ways to cut costs and help keep your budget in line.

Blogger Suzy Turner recommends the following to help keep costs in line during the early stages of parenthood.

Use cloth nappies

Nappies can be a significant upfront expense early on in your parenting journey.

As such, many are turning to reusable cloth nappies, which, although they require more upfront expense, can help cut costs in the long run.

Use social media to swap or purchase second-hand baby gear

Nowadays, social media can help form communities around just about anything.

Utilising local Facebook groups for new parents can help you swap advice on saving money and even purchase second-hand baby items for a fraction of the cost.

Embrace hand-me-downs from family and friends

While asking for help may not come easily to all parents, many baby clothes are worn for such a short time that they remain in excellent condition when they are no longer needed. As a result, most new parents are likely to have items to share.

If you have family or friends whose children are a bit further along in their development, reaching out to them for hand-me-downs can be a great way to save money while still receiving quality items from people who understand precisely what you’re going through.

Look for free local activities

Many community groups and organisations offer free activities for new mums and dads in spaces like libraries and village halls.

These can include outdoor activities in parks, storytime at the local library, and more. So, look into what’s available in your local area.

Be discerning with your choices of gadgets

The modern parent has access to a wide variety of gizmos and gadgets to help them and their little ones. However, these can prove to be very expensive!

Before you grab the credit card and splurge on every new device you can get your hands on, consider which ones you should prioritise and take a beat to avoid any impulse purchases.

Taking time to determine whether you really ‘need’ that new fancy piece of technology could save you a small fortune.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

22 Apr, 2025 | Admin | No Comments

Supermarket own-brand cheddar cheese officially crowned better than Cathedral City and Davidstow

In news which might have shocked shoppers, Which? recently revealed that a supermarket own-brand butter fared better than Lurpak in a blind taste test.

A panel of 67 people picked Aldi’s Norpak as the overall winner, rating it highly for its creaminess, colour and well-rounded flavour.

Now another consumer panel has also voted in favour of a supermarket own-brand product, while trying to find the UK’s best cheddar cheese.

Which? pitted branded cheeses by Cathedral City, Pilgrims Choice and Davidstow against ones from popular retailers like Sainsbury’s and Aldi and it might come as a surprise to some that it was Tesco that came out on top.

Tesco Finest Mature English Cheddar Cheese garnered a score of 78%, being praised for its taste and ‘firm, smooth’ texture.

Testers thought the salt level and strength of flavour were just right and it was found to be ‘pleasingly crumbly and creamy’ too.

The cheese is said to be ‘about average price-wise’ compared with other cheeses in the test, costing £4 for 350g (£1.14 per 100g), but interestingly it’s not actually cheaper than all of the bigger brands.

Davidstow Classic Cheddar came in second place, with a score of 75%. It was also awarded a ‘best buy’ accolade, despite being one of the priciest cheddars on the list at £4.75 for 350g (£1.36 per 100g).

The panel thought it was a ‘solid choice’ and shoppers were urged to look out for deals and special offers so they could nab a block while it was cheaper.

The Cornish Cove Mature Cheddar Cheese from M&S came in third place (£4.25 for 350g), while Castello Tickler Mature Cheddar Cheese (£4.75 for 300g) came in fourth.

Cathedral City Mature Cheddar (£3.50 for 350g) was in joint-fifth place with Pilgrims Choice Mature Cheddar (£4.20 for 350g), followed by Sainsbury’s Barber’s Mature Cruncher Cheese (£4 for 350g) and Aldi’s Specially Selected West Country Mature Cheddar (£2.99 for 350g).

Co-op’s Irresistible Somerset Mature Cheddar Cheese (£4.50 for 340g) took last place in the test, as those who tried it said it ‘lacked the crumble of a good cheese’, was ‘too smooth’ and the flavour was also criticised.

How was the cheese tested?

A panel of 76 people tested the cheeses in a blind taste test which took place in September 2024.

The group consisted of people who regularly buy and eat cheddar and were a mix of various ages and genders.

Each of the cheeses were tried in a private booth, so no one could discuss their thoughts or be influenced by anyone else.

All of the cheddars were then rated on taste, texture, aroma and appearance, with each person sharing what they liked and didn’t like.

The final scores were based on 50% flavour, 20% aroma, 15% appearance and 15% texture.

Cheddar cheese ranking from the blind taste test:

- Tesco Finest Mature English Cheddar Cheese, 78%

- Davidstow Classic Cheddar, 75%

- M&S Cornish Cove Mature Cheddar Cheese, 73%

- Castello Tickler Mature Cheddar Cheese, 71%

- Cathedral City Our Mature Cheddar and Pilgrims Choice Mature Cheddar, both with a score of 70%

- Sainsbury’s Barber’s Mature Cruncher Cheese, Taste the Difference, 69%

- Aldi Specially Selected West Country Mature Cheddar, 68%

- Co-op Irresistible Somerset Mature Cheddar Cheese, 66%

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

21 Apr, 2025 | Admin | No Comments

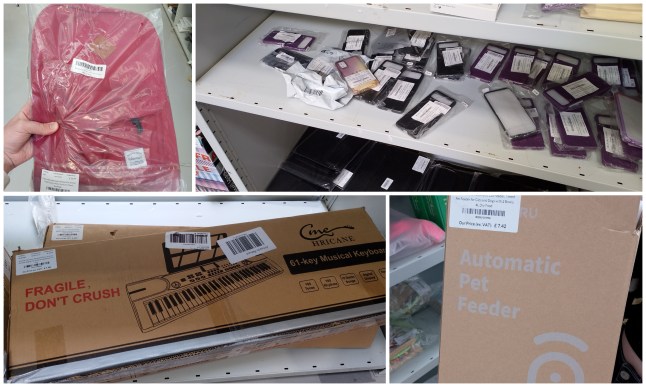

I visited the Amazon returns warehouse where everything is discounted

From cut-price books to air fryers, Amazon receives a staggering 13million orders every single day.

Of course, not every purchase is a successful one — so what happens to those ill-fitting clothes, gadgets you don’t actually need, and far-too-big furniture when you send it all back?

Well, they could end up at Trade Outlet, a little-known UK chain, which gives shoppers the chance to buy Amazon overstock and returns at massively discounted prices.

With seven locations across England and Wales, receiving 20,000 new items a day, discounts can reach a whopping 85% off.

I love a good bargain. From far-away charity shop trips to early morning January sales, I’ve been known to go to ridiculous lengths for a great deal.

With the sun shining, I headed to Trade Outlet’s largest location, just outside Chester, ready to unleash my inner David Dickinson (minus the tan) and score a steal of a deal.

Preparing for your visit

Before you hire a van and drain your bank account, there are a few details to bear in mind.

Trade Outlet is a predominantly business-to-business (B2B) seller. This means that, similar to Costco, you’ll need to register for an account before you shop, which can be done online or in person. Unlike Costco though, no proof of trading is required, and anyone can shop here.

Although email receipts are provided, there is a no returns policy. In fact, the website states: ‘As we operate outside of the typical consumer legislation, all stock is sold as-is aside from exceptional circumstances’.

All prices at Trade Outlet are listed excluding VAT — so remember that all of your items will be more expensive at the till.

My first impressions of Trade Outlet

I arrived bright and early, when the store opened at 10am. Despite proudly being a new account holder, this wasn’t checked by staff — I simply strolled in and started shopping.

As you walk through the door, the sheer size of the place hits you square in the face.

It resembles something akin to a really big charity shop combined with a jumble sale, and the downstairs area of an IKEA — there are giant shelves stocked with all manner of mysterious-looking parcels and packages.

The sections are roughly organised into categories like ‘Electronics’, ‘Books’, ‘Christmas’, ‘Arts and Crafts’, and more, and my brain starts to hurt as it quickly becomes evident that this is going to take some effort.

The only way to really seek out potential bargains is to get in the thick of it, riffling among the shelves and sifting through the stock.

While I had worried about being barged out of the way by FOMO-mad shoppers, this wasn’t the case — the store is so big that it easily accommodates large crowds.

Heading first to the electronics aisle, I immediately spy a whole load of wireless earbuds, all with an RRP of around £20, being sold off for fraction of the cost, at just £2.

I also spot a paper shredder with an RRP of £74.99 on sale for just over £10, various phone cases between £1 and £2, and even a foot massager reduced from £116.20 to just £19.22. One fancy looking iPad case had been slashed from £97.90 to £23.60.

I’ll be honest, in some of the sections, it was clear to see why these products hadn’t been snapped up for their original prices online: there was an inexplicable abundance of photo frames, curtain poles and random computer parts.

There were also the kinds of purchases that I imagined someone had drunk-ordered, only to return when they sobered up — items like said foot massager and a child’s keyboard with a £50+ RRP.

Still, it was the furniture section that impressed me the most. I spotted a luxury leather reclining three-seater sofa (in surprisingly good nick) for £149.51— a £550 saving on its original RRP — and a velvet sofa for £47.40, down from £223.99.

It struck me that Trade Outlet could be a haven for budding interior designers, in the same way that Facebook Marketplace is, transforming these buys into something more stylish.

Perhaps the best bargain I found was also in this section: an L-shaped desk with a price tag of just £7.81, down from £78.08 RRP.

After leaving the furniture, I stepped into another section with much potential: clothing.

I walked between never-ending racks of coats, jumpers, shirts, dresses, shoes and accessories.

Several smart-casual blazers by Paul Jones caught my eye, priced at around a fiver (usually at least £60 or more), as well as a long trench coat that was supposed to be £62.17 for £10.36.

This could also be a hidden gem for parents, as there was a huge selection of books and puzzles for little ones.

The weirdest products at Trade Outlet

Like all stores of this kind, some of the finds at Trade Outlet are truly bizarre, and I found myself laughing out loud on more than one occasion.

Some of the strangest highlights included a child’s ski and snowboard training harness (RRP £59.99, priced at £12.68), at-home drug test screens (£2.17), a sling pet carrier (RRP £18.98, priced at £3.17), and even a wooden box urn for ‘human cremation and pet dog ashes’ (£2.40).

Other honourable mentions include a Ninja-style headband (£1.50), graduation cap and gown costume (£4), and a very Sopranos-esque money clip, priced at £5.22.

Everything I bought at Trade Outlet

Quite a lot, actually. Here’s my full shopping list:

- Wireless headphones: £2

- MacBook case: £2.67 (RRP £15.98)

- Microphone covers: 80p

- Silicone baby’s dummy case: £1.40.

- Blue corduroy sports jacket: £4.17

- Blue cufflinks with a matching bowtie and pocket square: 83p

- Patterned slim tie: £1.60.

- Green suede handbag: £1.17

- Brown button-down corduroy over shirt: £4.67

- Keychain phone charger: £1.69

- Car air fresheners: £1.17

- Shoelaces: 45p

- Phone case: £1.83

- Pet sling: £3.17 (With apologies to my partner’s dog, Rowdy — I did try and talk her out of it.)

- Two Trade Outlet ‘mystery boxes’: £20 each

Total bill: £60 (including VAT)

What was in the Trade Outlet ‘Mystery Boxes’?

Speaking to one of the store staff, I’m told it’s not unheard of for shoppers to find brand-new phones, projectors, and other high-end items in their mystery boxes.

While this made everything very exciting, it’s fair to say that we had no such luck.

Our two mystery boxes contained around 40 items, ranging from vaguely useful to utterly ridiculous.

Some highlights included a set of (quite nice) champagne glasses, cups, cactus seeds, guitar picks, touchscreen gloves, odd electronic adapters, and a 13-piece set of garden sprinkler attachments. Lovely.

However, some of the more bizarre picks included printer cartridges for a Lexmark, a Scotland-themed drawstring bag, three sets of decorations for a children’s birthday party, self-adhesive metal tape, some drill bits, two matching sailor costumes (yes, really), and… a pot of blue slime.

There were also several items that, to my mind, were completely unidentifiable in their purpose in the absence of clear labelling.

And, for the record, I also now own enough phone cases to start up a shop in a motorway service station.

My verdict on Trade Outlet

Will any of the items I purchased today change my life? No, probably not. Am I glad I went and checked out Trade Outlet? Absolutely.

The key to navigating this kind of shopping is a mixture of perseverance, timing, and good luck.

You could quite literally spend hours looking through all the various nooks and crannies of the place, but I’m not sure anyone has that kind of time.

Although most of the items I found were unbranded (or brands I didn’t recognised), the website claims that spotting high-end names isn’t not uncommon — maybe I’ll have better luck next time?

Plus, with so many items being added to the shelves daily, your potential for bargains changes wildly, and every day is essentially a new roll of the dice.

I, for one, will definitely be stopping by from time to time.

That being said, I won’t opt for another mystery box until I figure out what on earth to do with the contents of the last two.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.