Ask any parent, and they will tell you that having children is an expensive business. However, it turns out some mums and dads spend vast sums on items their kids don’t need or want.

UK parents collectively waste a staggering £7billion on items for children that just don’t get used, according to data published by iCandy.

For context, that would be enough to give every single user on Facebook about £5 each.

Nearly 60% of parents admitted to buying items that were either never used or used less than twice in the first 12 months, wasting an average of £379 each.

57% of the parents surveyed retrospectively said they had bought too much stuff for their baby, and 46% admitted to regretting doing so.

Perhaps unsurprisingly, cuddly toys were found to have topped the list of unused items – the adorable faces of plush animals can sometimes be hard to say no to in the store, and we all know that kids can be particularly choosy with what they actually take to.

Outgrown clothing and shoes are also high on the list, neither of which will be particularly surprising, with your little uns’ sometimes growing at what seems like lightning speed.

However, some of the items parents ended up not using may raise an eyebrow.

A staggering 28% of the parents surveyed confessed to never having used some of their baby towels – an item you’d think you could never have enough of! – with bath supports or seats also coming in 5th on the list.

Hardly an impulse purchase!

What do parents waste money on

Out of the over 1,000 parents with kids under 10 that iCandy spoke to, the baby items they confessed to never having used were as follows:

- Cuddly toys – 30%

- Baby towels – 28%

- Baby shoes – 25%

- Clothes that were outgrown before they could be worn – 25%

- Bath support/seat – 21%

- Baby walker – 20%

- Bath thermometer – 19%

- Nappy bin/genie – 19%

- Breast pump – 18%

- Baby sling – 17%

- Fiddly/fancy outfits with buttons/layers etc – 16%

- Baby food blender – 15%

Source: iCandy

How to cut down on costs as a new parent

As a new parent, being more judicious with your spending on some of the items above can help you avoid the potential for this almost £400 mistake.

However, there are other ways to cut costs and help keep your budget in line.

Blogger Suzy Turner recommends the following to help keep costs in line during the early stages of parenthood.

Use cloth nappies

Nappies can be a significant upfront expense early on in your parenting journey.

As such, many are turning to reusable cloth nappies, which, although they require more upfront expense, can help cut costs in the long run.

Use social media to swap or purchase second-hand baby gear

Nowadays, social media can help form communities around just about anything.

Utilising local Facebook groups for new parents can help you swap advice on saving money and even purchase second-hand baby items for a fraction of the cost.

Embrace hand-me-downs from family and friends

While asking for help may not come easily to all parents, many baby clothes are worn for such a short time that they remain in excellent condition when they are no longer needed. As a result, most new parents are likely to have items to share.

If you have family or friends whose children are a bit further along in their development, reaching out to them for hand-me-downs can be a great way to save money while still receiving quality items from people who understand precisely what you’re going through.

Look for free local activities

Many community groups and organisations offer free activities for new mums and dads in spaces like libraries and village halls.

These can include outdoor activities in parks, storytime at the local library, and more. So, look into what’s available in your local area.

Be discerning with your choices of gadgets

The modern parent has access to a wide variety of gizmos and gadgets to help them and their little ones. However, these can prove to be very expensive!

Before you grab the credit card and splurge on every new device you can get your hands on, consider which ones you should prioritise and take a beat to avoid any impulse purchases.

Taking time to determine whether you really ‘need’ that new fancy piece of technology could save you a small fortune.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

22 Apr, 2025 | Admin | No Comments

Supermarket own-brand cheddar cheese officially crowned better than Cathedral City and Davidstow

In news which might have shocked shoppers, Which? recently revealed that a supermarket own-brand butter fared better than Lurpak in a blind taste test.

A panel of 67 people picked Aldi’s Norpak as the overall winner, rating it highly for its creaminess, colour and well-rounded flavour.

Now another consumer panel has also voted in favour of a supermarket own-brand product, while trying to find the UK’s best cheddar cheese.

Which? pitted branded cheeses by Cathedral City, Pilgrims Choice and Davidstow against ones from popular retailers like Sainsbury’s and Aldi and it might come as a surprise to some that it was Tesco that came out on top.

Tesco Finest Mature English Cheddar Cheese garnered a score of 78%, being praised for its taste and ‘firm, smooth’ texture.

Testers thought the salt level and strength of flavour were just right and it was found to be ‘pleasingly crumbly and creamy’ too.

The cheese is said to be ‘about average price-wise’ compared with other cheeses in the test, costing £4 for 350g (£1.14 per 100g), but interestingly it’s not actually cheaper than all of the bigger brands.

Davidstow Classic Cheddar came in second place, with a score of 75%. It was also awarded a ‘best buy’ accolade, despite being one of the priciest cheddars on the list at £4.75 for 350g (£1.36 per 100g).

The panel thought it was a ‘solid choice’ and shoppers were urged to look out for deals and special offers so they could nab a block while it was cheaper.

The Cornish Cove Mature Cheddar Cheese from M&S came in third place (£4.25 for 350g), while Castello Tickler Mature Cheddar Cheese (£4.75 for 300g) came in fourth.

Cathedral City Mature Cheddar (£3.50 for 350g) was in joint-fifth place with Pilgrims Choice Mature Cheddar (£4.20 for 350g), followed by Sainsbury’s Barber’s Mature Cruncher Cheese (£4 for 350g) and Aldi’s Specially Selected West Country Mature Cheddar (£2.99 for 350g).

Co-op’s Irresistible Somerset Mature Cheddar Cheese (£4.50 for 340g) took last place in the test, as those who tried it said it ‘lacked the crumble of a good cheese’, was ‘too smooth’ and the flavour was also criticised.

How was the cheese tested?

A panel of 76 people tested the cheeses in a blind taste test which took place in September 2024.

The group consisted of people who regularly buy and eat cheddar and were a mix of various ages and genders.

Each of the cheeses were tried in a private booth, so no one could discuss their thoughts or be influenced by anyone else.

All of the cheddars were then rated on taste, texture, aroma and appearance, with each person sharing what they liked and didn’t like.

The final scores were based on 50% flavour, 20% aroma, 15% appearance and 15% texture.

Cheddar cheese ranking from the blind taste test:

- Tesco Finest Mature English Cheddar Cheese, 78%

- Davidstow Classic Cheddar, 75%

- M&S Cornish Cove Mature Cheddar Cheese, 73%

- Castello Tickler Mature Cheddar Cheese, 71%

- Cathedral City Our Mature Cheddar and Pilgrims Choice Mature Cheddar, both with a score of 70%

- Sainsbury’s Barber’s Mature Cruncher Cheese, Taste the Difference, 69%

- Aldi Specially Selected West Country Mature Cheddar, 68%

- Co-op Irresistible Somerset Mature Cheddar Cheese, 66%

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

21 Apr, 2025 | Admin | No Comments

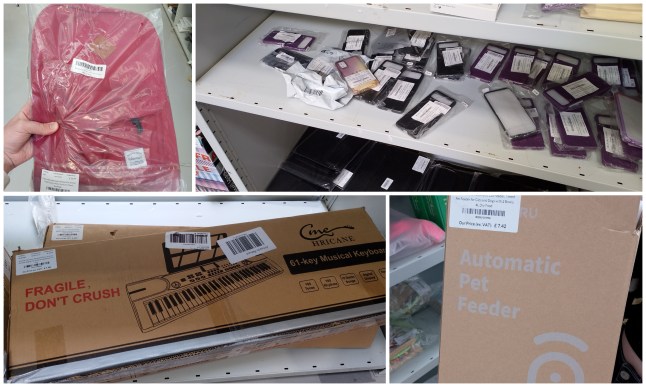

I visited the Amazon returns warehouse where everything is discounted

From cut-price books to air fryers, Amazon receives a staggering 13million orders every single day.

Of course, not every purchase is a successful one — so what happens to those ill-fitting clothes, gadgets you don’t actually need, and far-too-big furniture when you send it all back?

Well, they could end up at Trade Outlet, a little-known UK chain, which gives shoppers the chance to buy Amazon overstock and returns at massively discounted prices.

With seven locations across England and Wales, receiving 20,000 new items a day, discounts can reach a whopping 85% off.

I love a good bargain. From far-away charity shop trips to early morning January sales, I’ve been known to go to ridiculous lengths for a great deal.

With the sun shining, I headed to Trade Outlet’s largest location, just outside Chester, ready to unleash my inner David Dickinson (minus the tan) and score a steal of a deal.

Preparing for your visit

Before you hire a van and drain your bank account, there are a few details to bear in mind.

Trade Outlet is a predominantly business-to-business (B2B) seller. This means that, similar to Costco, you’ll need to register for an account before you shop, which can be done online or in person. Unlike Costco though, no proof of trading is required, and anyone can shop here.

Although email receipts are provided, there is a no returns policy. In fact, the website states: ‘As we operate outside of the typical consumer legislation, all stock is sold as-is aside from exceptional circumstances’.

All prices at Trade Outlet are listed excluding VAT — so remember that all of your items will be more expensive at the till.

My first impressions of Trade Outlet

I arrived bright and early, when the store opened at 10am. Despite proudly being a new account holder, this wasn’t checked by staff — I simply strolled in and started shopping.

As you walk through the door, the sheer size of the place hits you square in the face.

It resembles something akin to a really big charity shop combined with a jumble sale, and the downstairs area of an IKEA — there are giant shelves stocked with all manner of mysterious-looking parcels and packages.

The sections are roughly organised into categories like ‘Electronics’, ‘Books’, ‘Christmas’, ‘Arts and Crafts’, and more, and my brain starts to hurt as it quickly becomes evident that this is going to take some effort.

The only way to really seek out potential bargains is to get in the thick of it, riffling among the shelves and sifting through the stock.

While I had worried about being barged out of the way by FOMO-mad shoppers, this wasn’t the case — the store is so big that it easily accommodates large crowds.

Heading first to the electronics aisle, I immediately spy a whole load of wireless earbuds, all with an RRP of around £20, being sold off for fraction of the cost, at just £2.

I also spot a paper shredder with an RRP of £74.99 on sale for just over £10, various phone cases between £1 and £2, and even a foot massager reduced from £116.20 to just £19.22. One fancy looking iPad case had been slashed from £97.90 to £23.60.

I’ll be honest, in some of the sections, it was clear to see why these products hadn’t been snapped up for their original prices online: there was an inexplicable abundance of photo frames, curtain poles and random computer parts.

There were also the kinds of purchases that I imagined someone had drunk-ordered, only to return when they sobered up — items like said foot massager and a child’s keyboard with a £50+ RRP.

Still, it was the furniture section that impressed me the most. I spotted a luxury leather reclining three-seater sofa (in surprisingly good nick) for £149.51— a £550 saving on its original RRP — and a velvet sofa for £47.40, down from £223.99.

It struck me that Trade Outlet could be a haven for budding interior designers, in the same way that Facebook Marketplace is, transforming these buys into something more stylish.

Perhaps the best bargain I found was also in this section: an L-shaped desk with a price tag of just £7.81, down from £78.08 RRP.

After leaving the furniture, I stepped into another section with much potential: clothing.

I walked between never-ending racks of coats, jumpers, shirts, dresses, shoes and accessories.

Several smart-casual blazers by Paul Jones caught my eye, priced at around a fiver (usually at least £60 or more), as well as a long trench coat that was supposed to be £62.17 for £10.36.

This could also be a hidden gem for parents, as there was a huge selection of books and puzzles for little ones.

The weirdest products at Trade Outlet

Like all stores of this kind, some of the finds at Trade Outlet are truly bizarre, and I found myself laughing out loud on more than one occasion.

Some of the strangest highlights included a child’s ski and snowboard training harness (RRP £59.99, priced at £12.68), at-home drug test screens (£2.17), a sling pet carrier (RRP £18.98, priced at £3.17), and even a wooden box urn for ‘human cremation and pet dog ashes’ (£2.40).

Other honourable mentions include a Ninja-style headband (£1.50), graduation cap and gown costume (£4), and a very Sopranos-esque money clip, priced at £5.22.

Everything I bought at Trade Outlet

Quite a lot, actually. Here’s my full shopping list:

- Wireless headphones: £2

- MacBook case: £2.67 (RRP £15.98)

- Microphone covers: 80p

- Silicone baby’s dummy case: £1.40.

- Blue corduroy sports jacket: £4.17

- Blue cufflinks with a matching bowtie and pocket square: 83p

- Patterned slim tie: £1.60.

- Green suede handbag: £1.17

- Brown button-down corduroy over shirt: £4.67

- Keychain phone charger: £1.69

- Car air fresheners: £1.17

- Shoelaces: 45p

- Phone case: £1.83

- Pet sling: £3.17 (With apologies to my partner’s dog, Rowdy — I did try and talk her out of it.)

- Two Trade Outlet ‘mystery boxes’: £20 each

Total bill: £60 (including VAT)

What was in the Trade Outlet ‘Mystery Boxes’?

Speaking to one of the store staff, I’m told it’s not unheard of for shoppers to find brand-new phones, projectors, and other high-end items in their mystery boxes.

While this made everything very exciting, it’s fair to say that we had no such luck.

Our two mystery boxes contained around 40 items, ranging from vaguely useful to utterly ridiculous.

Some highlights included a set of (quite nice) champagne glasses, cups, cactus seeds, guitar picks, touchscreen gloves, odd electronic adapters, and a 13-piece set of garden sprinkler attachments. Lovely.

However, some of the more bizarre picks included printer cartridges for a Lexmark, a Scotland-themed drawstring bag, three sets of decorations for a children’s birthday party, self-adhesive metal tape, some drill bits, two matching sailor costumes (yes, really), and… a pot of blue slime.

There were also several items that, to my mind, were completely unidentifiable in their purpose in the absence of clear labelling.

And, for the record, I also now own enough phone cases to start up a shop in a motorway service station.

My verdict on Trade Outlet

Will any of the items I purchased today change my life? No, probably not. Am I glad I went and checked out Trade Outlet? Absolutely.

The key to navigating this kind of shopping is a mixture of perseverance, timing, and good luck.

You could quite literally spend hours looking through all the various nooks and crannies of the place, but I’m not sure anyone has that kind of time.

Although most of the items I found were unbranded (or brands I didn’t recognised), the website claims that spotting high-end names isn’t not uncommon — maybe I’ll have better luck next time?

Plus, with so many items being added to the shelves daily, your potential for bargains changes wildly, and every day is essentially a new roll of the dice.

I, for one, will definitely be stopping by from time to time.

That being said, I won’t opt for another mystery box until I figure out what on earth to do with the contents of the last two.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

11 Apr, 2025 | Admin | No Comments

Pret is giving away hundreds of free iced drinks — but you’ll have to be quick

It’s Friday, the sun is shining and it’s shaping up to be the hottest day of the year so far… what more could you want?

Well, if your answer was a free iced drink, then you’re in luck as your wish is Pret’s command.

The coffee chain is celebrating the warm weather and recent surge in sales of iced drinks by giving away free beverages at select shops.

There are of course a few caveats to this exciting news though – there are only two drinks to choose from: The Raspberry Lemonade Cooler & Feelin’ Peachy Cooler.

The Coolers, which usually cost £4.20 each, are limited to one drink per customer and they’re only available at four shops, three of which are located in London.

Customers can claim a free drink today (Friday, April 11) from the Hackney store on Amhurst Road, the Pret on Parsons Green Lane, 140 Aldersgate on Long Lane Street (all in London) and at Cross Street in Manchester.

Briony Raven, Chief Customer and Product Officer at Pret A Manger, said: ‘We’re thrilled to bring a little burst of refreshment to customers with this cooler giveaway. We’ve seen Barista-made iced drinks boom in popularity recently and we thought no better time to share some joy with our customers than by giving them some free Pret Coolers on the hottest day of the year.

‘Whether you’re grabbing one on your way to the park or just treating yourself to a midday pick-me-up, it’s the perfect way to welcome warmer days.’

If you prefer a hot drink instead of an iced one, there are also numerous ways to claim a free coffee from popular chains.

Customers with Octopus Energy are able to enjoy one free drink a week from Caffè Nero or Greggs if they have the app and a smart meter.

Freebie options at Caffè Nero include iced pistachio and cherry lattes of any size as well as all other cold and hot drinks that aren’t branded ‘luxury’, ‘speciality’ or ‘seasonal’. While the options at Greggs range from speciality lattes, hot chocolate and espresso to cappuccino.

Latest London news

- Huge fire engulfs two flats in east London block

- Chinese spies are ‘bugging London’s pubs and park benches,’ security sources say

- Inside the plans to revamp London Liverpool Street station

To get the latest news from the capital visit Metro’s London news hub.

Meanwhile, if you sign up to MyWaitrose, you can claim a free americano, cappuccino, latte or tea from the self-service machines in Waitrose stores without making a purchase, as long as you bring a reusable cup and scan your loyalty card. This entitles you to one free drink a day.

You can also claim one free drink at Caffè Nero when you link your Caffe Nero app to MyWaitrose.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

9 Apr, 2025 | Admin | No Comments

UK passport holders have 24 hours before ‘insane’ price increase — here’s how to avoid it

Bad news for holidaymakers: the price of a British passport is going up again this week.

After years of hiking costs that have had a direct impact on travellers, the government has announced that new fees will come into place on Thursday, 10 April — and will see a variety of services provided by HM Passport Office put their prices up.

Across the board, prices will rise by 7%. In real terms, that means online passport applications for adults will climb to £94.50, while fees for children’s passports will rise to £61.50.

The move takes the total price rise in two years to 25 percent — more than twice the current rate of inflation.

In even bleaker news, it makes the UK passport one of the most expensive in Europe, putting it almost on par with Denmark (£100) and Italy (£97).

Alongside the price hike, Brits heading to EU countries, as well as Norway, Iceland, Switzerland and Liechtenstein, are being urged to check their documents carefully.

UK passports must comply with strict entry rules, with a ‘date of issue’ that’s less than 10 years old when you arrive in the country, and an expiry date at least three months after the date you plan to leave.

Here’s everything you need to know about the passport price rise — including who should renew before 10 April.

How are people reacting?

Travellers have lashed out at the price hike on TikTok, with a man called Chris writing: ‘WHY IS EVERYTHING GOING UP EXCEPT WAGES …drives me insane.’

A woman named Naya added: ‘My daughter has a French passport and we are renewing for 17 euros, or £14. That’s a joke, we’ll keep the French passport then. My other daughter has a British passport and we will go for a French one for her now, too.’

Others said they haven’t been able to afford to renew their passports in recent years.

The price increase is the latest headache for Brits planning international trips. And, as experts tell Metro, it’s just another added expense that hits everyday people hardest.

‘Whether you’re a young person gearing up for your first adventure, or a family trying to sort passport renewals before the school holidays, this increase really lands at the worst time – especially with the cost of everything else still climbing,’ Jessie Chambers, senior travel expert at Global Work and Travel, says.

‘For young travellers, a passport is the starting point for any journey, and what should be a straightforward step suddenly feels like a financial obstacle.’

For families, it’s even harder. Jessie notes that passports often expire at the same time, so renewing one means renewing them all.

‘That can easily add up to hundreds of pounds in one hit,’ she says.

‘For many, it could be the difference between affording a break or having to cancel plans.’

Beyond individual cases, rocketing passport costs could change the face of travel as we know it.

‘If these costs keep rising, we’ll likely see fewer people able to afford trips abroad, and that could affect how many people from the UK choose (or are able) to travel in the years ahead,’ says Jessie.

She adds: ‘We shouldn’t be treating passports like a luxury item. When something so basic starts to feel out of reach, that’s a real issue.’

On the flip side, the rise could be good news for UK hotels and tourist businesses.

‘While the passport fee alone won’t likely deter international travel, these cumulative expenses following years of inflation may make European trips less accessible for budget-conscious families,’ Zoe Adjey, Senior Lecturer at the Institute of Tourism and Hospitality at the University of East London, tells Metro.

‘A potential silver lining could be increased domestic tourism as some Britons reconsider foreign holidays due to these mounting costs and barriers.’

How much does it cost to get a UK passport currently?

- Adult online application: £88.50

- Child online application: £57.50

- Adult postal application: £100

- Child postal application: £69

- Premium 1-day rapid adult application: £207.50

- Premium 1-day rapid child application: £176.50

- Online overseas adult application: £101

- Online overseas child application: £65.50

- Postal overseas adult application: £112.50

- Postal overseas child application: £77.

How much will getting a UK passport cost from April 10?

- Adult online application: £94.50

- Child online application: £61.50

- Adult postal application: £107

- Child postal application: £74

- Premium 1-day rapid adult application: £222

- Premium 1-day rapid child application: £189

- Online overseas adult application: £108

- Online overseas child application: £70

- Postal overseas adult application: £120.50

- Postal overseas child application: £82.50.

Why is the price of passports rising?

According to the Home Office, the new fees will cover the cost of passport processing and consular services such as support for lost or stolen documents abroad.

A statement from the department said: ‘The new fees will help the Home Office to continue to move towards a system that meets its costs through those who use it, reducing reliance on funding from general taxation.

‘The government does not make any profit from the cost of passport applications.’

It said the fees will also go towards the cost of processing British citizens at UK borders.

HM Passport Office recommends holidaymakers renew their passports in good time.

How long does it take to renew a UK passport?

The Home Office says that last year, where no further information was required, 99.7% of standard applications from the UK were processed within three weeks.

It could however take longer if you’re applying from a different country.

There are premium or one-week fast-track services available for those who need a passport urgently.

People can call the passport advice line if they need to travel urgently for medical treatment or because a friend or family member is seriously ill or has died.

Should I renew before the price goes up?

Travel experts such as ‘the man who pays his way’, Simon Calder, say yes — on two conditions.

You should renew before 10 April – the day of the increase – if your passport is due to expire by 25 November 2025, or if you plan to travel abroad before that date.

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.

3 Apr, 2025 | Admin | No Comments

List of UK items Trump’s tariffs will hit the hardest with three key industries affected

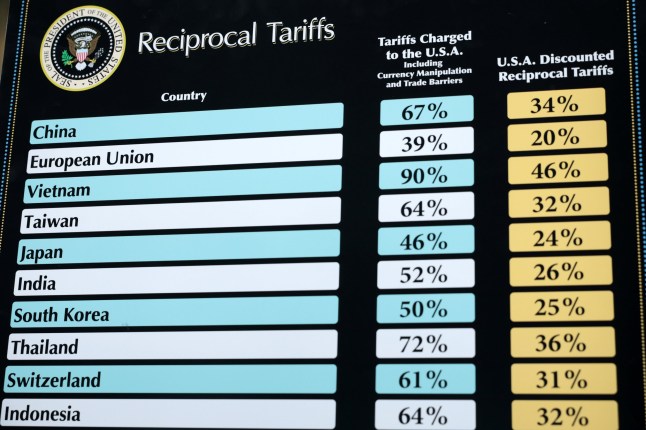

In just 50 seismic minutes, Donald Trump flipped the world’s trading system on its head, branded other nations ‘foreign scavengers’ and called the EU ‘pathetic’ for ‘ripping off’ the US.

The US president had been billing his ‘liberation day’ as one of the most important days in the country’s history – and it’s certainly lived up to it.

At the ‘Make America Wealthy Again’ address on the White House’s famous Rose Garden, Trump didn’t hold back, holding up his chart of ‘reciprocal’ tariffs to show to the world.

Ahead of the announcements, Prime Minister Keir Starmer said: ‘A trade war is in nobody’s interest, and the country deserves and we will take a calm, pragmatic approach.

‘Our decisions will always be guided by our national interest, and that’s why we have prepared for all eventualities and we will rule nothing out.’

Now, the UK has been hit with a 10% tariff on exports to the United States – a bit of a relief for Britain, considering talks of 20% tariffs on UK goods were mentioned initially.

However, UK residents will still be impacted, and the price of certain goods will increase, economists said.

After the announcement, business and trade secretary Jonathan Reynolds said: ‘The US is our closest ally, so our approach is to remain calm and committed to doing this deal, which we hope will mitigate the impact of what has been announced today.’

Here’s a list of products and goods which could see price increases after Trump’s announcement.

To view this video please enable JavaScript, and consider upgrading to a web

browser that

supports HTML5

video

Cars and the automotive industry

The UK car industry could take a hit after tariffs were introduced.

Some UK car brands which are sold in the US include: Jaguar Land Rover, Bentley, Rolls-Royce, McLaren, and Lotus.

Cars could soon increase in price for UK buyers as well after the European car market was slammed with tariffs from the US.

Many European car brands, such as BMW and Mercedes, rely on sales in the United States – so with these new tariffs, UK prices could increase as well.

It’s feared the 25% tariffs could put 25,000 jobs in the UK at risk, while Range Rovers could be almost $30,000 more expensive in the US.

Society of Motor Manufacturers & Traders statement Chief Executive Mike Hawes said: ‘ Our cars were already set to attract a punitive 25% tariff overnight and other automotive products are now set to be impacted immediately. While we hope a deal between the UK and US can still be negotiated, this is yet another challenge to a sector already facing multiple headwinds.

‘These tariff costs cannot be absorbed by manufacturers, thus hitting US consumers who may face additional costs and a reduced choice of iconic British brands, whilst UK producers may have to review output in the face of constrained demand.

‘Trade discussions must continue at pace, therefore, and we urge all parties to continue to negotiate and deliver solutions which support jobs, consumer demand and economic growth across both sides of the Atlantic.’

Cans and kitchen foil

Aluminium prices could be impacted – ranging from kitchenware to drinks and even kitchen foil.

Trump previously said he would place tariffs on aluminium imports to the United States.

But the impact aluminium tariffs could be felt hard in the hospitality industry on both sides of the Atlantic, analysists have warned.

Trump introduced a 25% levy on all beer imports and added beer cans to existing aluminium tariffs.

Micaela Pallini, president of Italian trade association Federvini, said in a statement: ‘Many labels, which cannot be replaced by local production, will disappear from the tables of US consumers, while a serious production and employment crisis is looming in Italy and Europe,.’

Mortgages

Believe it or not, tariffs on goods can actually affect your mortgage.

Inflation caused by the turmoil in the global economy (ie, tariffs), could affect interest rates in the UK.

Currently, the Bank of England’s base rate of a mortgage is currently 4.5%. That could be subject to change, depending on how bad inflation is.

Could any prices come down?

Thomas Sampson, Associate Professor in Economics at the London School of Economics, told Metro: ‘Many countries – particularly big exporting Asian countries – are now facing high tariffs on exports to the US, so it’s likely that some of that trade will be diverted elsewhere and could reduce prices in other countries.

‘We might see some of that trade being diverted to the UK, which could bring some downward pressure on UK prices.

‘But my guess is that will be a relatively small effect – because you know the countries that are facing the highest tariff they’re mostly countries that are a long way away from the UK that we don’t trade a huge amount.’

To view this video please enable JavaScript, and consider upgrading to a web

browser that

supports HTML5

video

How else could the tariffs affect your money?

The main way is interest rates.

These range from loans to credit cards and mortgages, as mentioned above. The rates could remain higher for longer, experts said.

But Mr Sampson points out: ‘The UK is such a service is lead economy because over half export is service-led. So we are less directly exposed to these tariffs than many other countries.

‘But this is why I think that the main effect is not going to come directly through the tariffs themselves, but the broad economic slowdown I’m expecting to come from them.’

What other countries are set to a 10% tariff?

Quite a few.

Brazil, Singapore, Chile, Australia, Turkey, Colombia, Peru, Costa Rica, the Dominican Republic, the United Arab Emirates, New Zealand, Argentina, Ecuador, Guatemala, Honduras, Egypt, Saudi Arabia, El Salvador, Trinidad and Tobago and Morroco have all been slapped with 10% tariffs.

Others got it worse. Now facing 54% tariffs on exports to the US, the world’s number two economy China vowed countermeasures, as did the European Union.

Both allies and foes united in criticism of measures they believe will deal a devastating blow to global trade.

‘The consequences will be dire for millions of people around the globe,’ EU chief Ursula von der Leyen said in a statement, adding the 27-member bloc was preparing to hit back if talks with Washington failed.

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.

31 Mar, 2025 | Admin | No Comments

Every bill going up from April 1 — and how to save hundreds by haggling

Brits are being urged to check the terms of their phone and broadband contracts and ensure they’re not overpaying council tax with bills rising from April 1.

This year ‘Awful April’ looks likely to be particularly painful, with nine in 10 councils taking the opportunity to raise taxes by the maximum allowed amount, and water bills rising by as much as 47%.

Although you can’t escape all hikes, with the right know-how, you can potentially save hundreds of pounds.

Below, we talk you through how to hack household bills as businesses and councils put up their prices to compensate for inflation and rising costs.

1. Council tax

Most of us will pay 5% more on our council tax from April – that’s an average of about an extra £109 a year for a Band D household – but a few unlucky folk will find the bill is much higher.

That’s because their council has been given permission to raise even more from customers because they are in dire financial straits.

Councils that can do this include Bradford, which will put up council tax by 10%, and the London borough of Newham, whose residents will pay 9% more.

Is there anything I can do about it?

Check you are not overpaying. There are a few reasons why council tax might be reduced. Full-time students, single people, carers and those with certain diagnoses are entitled to a discount, as are some people on low incomes, so check your council website to see if you are eligible.

You may also be able to apply to reduce your council tax band. The amount you pay in tax depends on the valuation of your house in 1991, and many properties have changed since then. There are more details on how to challenge the banding at gov.uk, though be aware that it comes with the risk you’ll go up a band, too!

2. Energy bills

The government cap on energy prices rises from April 1 to 6.4%, so if you’re on a capped energy tariff, the gas and electricity you are using will cost more. Energy regulator Ofgem says this will cost the average household £111 a year if prices remain at the new level. The cap itself only runs for three months, after which prices may rise or fall again.

Is there anything I can do about it?

If you are on a fixed-rate tariff, you won’t pay any more for your energy until that rate comes to an end.

If you aren’t, and your energy is on a capped tariff, now might be a good time to see if you can save by switching. Use comparison sites such as Uswitch, Moneysupermarket or Comparethe market to find cheaper deals.

Taking steps to reduce your energy bills will also pay dividends, although the good news is that the latest hike is coming in as the weather gets warmer and energy demand reduces.

Fiona Peake, consumer finance expert at Ocean Finance, suggests the following tweaks to bring bills down further. ‘Leaving appliances on standby overnight can add up to £100 a year to your bills. Switching everything off at the socket (except essentials like your fridge) can be an easy way to save,’ she says. ‘Another simple fix is lowering your boiler’s flow temperature to 60C. It won’t impact the warmth of your home but it could save you another £100 a year.’

3. Water bills

Water bills alone are set to increase by an average of £123 a year from April 1, a 26% increase, according to the Consumer Council for Water (CCW), which represents householders. Depending on where you live, some people will face even bigger rises, as water companies are raising their bills by different amounts.

Some of the highest rises include Southern Water, which is increasing bills by 47%, South West Water (32%), Thames Water (31%) and Yorkshire Water (29%).

Is there anything I can do about it?

Andy White, from the CCW, says that customers who are finding water bills difficult to pay should check whether they are eligible for a ‘social tariff’.

If you are eligible because you have a low income, you could save an average of £160 a year, while those with medical conditions that mean they use a lot of water could be eligible for WaterSure tariffs, with an average saving of £286 a year. Two in five households in the UK don’t have a meter and some would be better off if they switched.

You can try the CCW water meter calculator at ccw.org.uk to see if that could be you. You can also, unless you live in an area where water meters are compulsory, switch back again after two years if you are unhappy with it.

‘I saved £175 by switching to a water meter’

Sylvia Tillmann, from Ramsgate in Kent, is saving over £175 a year now she’s switched her water to a meter. Her bill used to be £300 a year, and now it is just under £125.

The 58-year-old lives in a one-bedroom flat, but still saved on her Southern Water bill by switching to a meter.

‘I’m not wasteful, very environmentally conscious, and take short showers rather than long ones,’ she says. ‘I only use the washing machine and dishwasher when it’s really full, so the meter hasn’t changed my behaviour at all, just saved me money.’

Sylvia says that she was prompted to get a meter by a friend who had also saved money, and although she had to wait a while for an engineer to come and fit it, the process was otherwise straightforward.

‘To start with, I was checking the meter all the time to see if it moved, and it only moved a little bit with each shower or use of the dishwasher,’ she says. ‘I couldn’t believe my savings, and I’d advise anyone who is careful with water like me to do this.’

4. Broadband and mobile bills

Broadband and mobile phone companies are allowed to put up your bills by an amount linked to inflation if this was in your contract when you signed up. Fiona, at Ocean Finance, says this could push bills up by six to 7.5%, adding £3-£5 per month to household expenses.

Is there anything I can do about it?

If you are out of contract, you can leave and get a better deal, or haggle with your current provider for a cheaper price by threatening to leave. Check out comparison sites such as Uswitch or Moneysupermarket for deals that might work for you.

If you’re in contract, chances are you’ll have to pay to leave, but do check whether they will waive exit penalties when prices rise. If the penalties are steep, make a calendar note of when the contract ends and switch as quickly as you can.

How to haggle your phone or broadband bill

Metro’s money expert Andy Webb, who runs financial blog Be Clever With Your Cash, shares his top tips to haggle down your phone or broadband bill.

‘If you’re out of contract, or soon will be, then this is the time to either find a new provider that charges less or haggle a better deal,’ he says.

Andy advises playing hardball with your phone provider.

‘Just tell the person you want to leave, and make sure you’re put through to the disconnection team as they have the most power when cutting prices,’ he explains. ‘You can even call their bluff and trigger the cancellation. Often they’ll call back with an even better deal. If they don’t you can always say you’ve changed your mind and accept the previous offer.’

When it comes to broadband, if you’re in contract, there’s not much you can do but wait to find out the increase, says Andy – with a few exceptions.

‘First, if you’re a Sky broadband or O2 mobile customer, these two companies will be charging more from April 1, but there are loopholes that mean you can cancel your contract. With Sky phone and broadband, though sadly not TV, it’s because Sky doesn’t have this increase baked into the contracts, so it’s a change in the terms you agreed to,’ he explains.

‘The opportunity to end an O2 contract early hasn’t been widely publicised, though the email I received also talked about other contract changes, such as fair usage on worldwide roaming. Whatever the reason, it still offers the opportunity to quit.

‘But you need to act fast. You’ve got 30 days from them telling you of the changes to tell them you want to leave (or use it as a bargaining chip). Since you might have had the communication in early February, the clock could already be ticking.

‘Another option worth exploring to beat the increases is if your internet speed hasn’t been what’s promised, and they’ve not been able to fix it in 30 days, then you can also cancel your contracts early.’

5. Car tax

How much more will I pay?

For most of us, the increase in car tax will be a relatively manageable £5 a year, to £195. For those with electric vehicles though, the increase will be high. These vehicles have been exempt from the tax but now will pay £10 for the first year before moving to the standard car tax rate.

Is there anything I can do about it?

Expensive vehicles attract more car tax, so ensuring you don’t have a vehicle with a ‘list price’ of over £40,000 will save you money. Otherwise you only get out of paying car tax if your car is off-road and declared as such, or is over 40 years old.

6. TV Licence

How much more will I pay?

The price for a standard colour TV licence is rising by £5 to £174.50.

Is there anything I can do about it?

If you want to watch live TV or BBC iPlayer then you will need a licence. If you watch only other catch-up services, you won’t, and can save the full amount. You can apply to cancel your licence online if this is the case at tvlicensing.co.uk. You can also fill out a declaration on the same site saying you don’t need a licence, to prevent TV Licensing pursuing you for the cash.

Beware, though, if you don’t pay and are discovered to be watching live TV or iPlayer, you could face a £1,000 fine. Otherwise if you’re over 75 and receive the pension credit benefit you’ll get a free TV licence, while those who are blind or significantly sight-impaired will receive a 50% discount.

Average annual extra cost per household

Energy: £111

Council tax: £109

Water: £123

Broadband and mobile: £50.40

Car tax: £5

TV Licence: £5

TOTAL: £403.40

Source: Hargreaves Lansdown

Rosie Murray-West is Metro’s personal finance specialist.

If you want more tips and tricks on saving money, as well as chat about cash and alerts on deals and discounts, join our Facebook Group, Money Pot.

29 Mar, 2025 | Admin | No Comments

Up to 3,500,000 Brits could receive £40 compensation for ‘dumb’ smart meters

While smart meters are a handy way to save money on your energy bills, it turns out millions across Great Britain may not actually work.

According to official figures, there have been a number of issues with the nationwide smart meter rollout, with as many as 3.5 million currently operating in ‘dumb’ mode, unable to send energy usage information.

As such, Ofgem has called on providers to urgently fix broken devices, proposing they issue £40 automatic compensation to those who have to wait longer than 90 days.

Under the regulator’s plans, customers will also receive a payout if a smart meter installation fails due to a fault within their provider’s control.

Amid government targets for three-quarters of all homes to use one by the end of this year, Uswitch research shows up to 1.4 million households in England, Wales and Scotland have waited six months or longer for their broken meter to be fixed.

However, the new proposals mean anyone who requests a new meter from their supplier will have to be offered one within six weeks, while suppliers will be required to provide a resolution plan to those who report problems with their device within five working days.

Tim Jarvis, director general for markets at Ofgem, said: ‘We’re drawing the line on excuses – suppliers will need to follow our new rules or compensate their customers.

We know that many customers are still waiting too long to get a smart meter installed or facing lengthy delays on repairs when it stops working.

‘That’s why we’re stepping in to make the process quicker and easier for consumers and to make sure they’re fairly compensated if things do go wrong.’

What is smart meter 'dumb mode'

According to Smart Energy GB: ‘‘Dumb mode’ is sometimes used to describe when smart meters are not automatically sending meter readings…

‘If your smart meter is in “dumb mode” or isn’t sending regular meter readings, it will still be measuring your energy use, but it won’t send that information automatically to your energy supplier.

‘To get accurate bills, you will need to take manual readings and share them with your supplier. You will need to take regular readings until the issue is solved, and your smart meter can send readings automatically again.’

Martin Lewis discussed the topic on a recent episode of his podcast with Octopus Energy boss Greg Jackson, who claimed repairs were often not prioritised because fixing existing smart meters doesn’t count towards the targets.

The Money Saving Expert (MSE) founder previously warned ministers that up to 20% of home smart meters are not working properly, urging them to change the current rules.

In a letter to Energy Secretary Ed Miliband, he wrote: ‘Repairs are slow, if they happen at all, as resources are focused on installs, leaving consumers frustrated and at risk of mis-billing and further problems.’

Ofgem’s proposals are due to be consulted on until May, after which further details on the compensation scheme will likely be released.

Miatta Fahnbulleh, the UK Minister for Energy Consumers, commented: ‘We want to make sure more consumers feel the benefits of having one installed.

‘A crucial part of that will be improving the smart meter customer experience, so we welcome Ofgem’s proposals to introduce guaranteed standards of performance for smart meters.

‘This will help to ensure people who want to upgrade their meters are better supported through the process, and can make the most of their new smart meter.’

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

26 Mar, 2025 | Admin | No Comments

Martin Lewis shares three-day warning to save £100s before energy price hike

According to Martin Lewis, 80% of households in England, Scotland and Wales currently overpay for energy — and in the coming months, it’s only going to get worse.

Ofgem just announced the price cap will be going up by 6.4% in April – following a 1% rise in January – with the energy regulator blaming an increase in the wholesale price of oil and gas.

That means the minimum bill for someone with typical dual-fuel use paying by Direct Debit will go up by over £100 a year, which Ofgem chief executive Jonathan Brearley will pose ‘a huge challenge for many households.’

But thankfully, there is a way to avoid the worst of the hike, with Martin claiming it could result in a typical annual saving of £200.

And the personal finance guru’s advice is simple: ‘Most people should consider locking in a cheap fix to avoid the hike.’

On the Money Saving Expert (MSE) newsletter, he explained that ‘a fixed tariff is where you lock in a rate for a set time (you still pay more if you use more, though), giving you the peace of mind of price certainty’.

Martin also added on X: ‘The cheapest year-long standalone fixes right now are about 4% less than the current cap, never mind once it rises in April.’

As many people are nervous about switching to a relatively unknown energy company for their price fix, Money Saving Expert has managed to wrangle an exclusive 16-month fix with British Gas, that’s available for new and existing customers.

However, it’s only available until 5pm on Friday, March 28. So you’ll want to act ‘urgently’ if you want to snap it up as there are just three days from now until then.

According to the experts, there’s only one smaller firm (Outfox the Market) that has a cheaper deal right now, and this is the ‘most competitive deal’ British Gas has offered in a while.

Martin says that in general the deal ‘looks strong’ but the exact fixed rate tariff that’s best for you will depend on your region and how much energy you use.

To find this out, you’ll want to put your details into a comparison tool (like MSE’s Cheap Energy Club) to see more personalised options.

Regardless of which deal you choose, the new price cap will come into play on April 1 and will last for three months, so you definitely have to switch before then.

However, Martin also warns that deals are being snapped up fast, so ‘getting it done ASAP is safest’ as ‘each day you sit on the Price Cap is a day you pay more than needed’.

Popular price capped tariffs

If you’re on one of the following, what you pay is determined by the price cap, which Martin says means you’re ‘likely overpaying and should sort now’.

- British Gas Standard Variable

- EDF Standard (Variable)

- E.on Next Next Flex

- Octopus Flexible Octopus

- Ovo Simpler Energy

- Scottish Power Standard

Alongside fixed rate tariffs, it’s worth looking into specialist alternatives that could save you cash.

EDF’s new Simply Tracker Extra tariff, for example, slashes £100 a year off the standing charge, and could be good for those with lower usage (roughly under £135 per month).

Alternatively, there are electric vehicle tariffs which could help EV drivers keep costs down, and rapid price-change options offering lower prices outside of peak periods for those who are able to shift their daily usage routine.

If you’re still struggling to pay, Martin recommends speaking to your energy provider to see how they can help.

‘Be polite and straight with it, and make sure you explain if you’re vulnerable,’ he says.

They may be able to put you forward for a hardship and debt grant, or work with you to negotiate a payment plan you can afford – everything’s decided on a case-by-case basis.

Under Ofgem rules, suppliers are obligated to help struggling customers, so get in touch with yours as soon as possible if you’re worried about your ability to pay.

How can I lower my energy bills?

Amy Knight, personal finance expert at the financial comparison website NerdWallet UK, told Metro: ‘While cutting down on energy use can help save money on bills, this isn’t always an option. Instead, focus on getting more value from the money you spend heating your home.’

Here are her top tips to keep fuel bills low this winter:

Ask for a refund if you’re overpaying into your energy bill by direct debit

If you’re several hundreds or even thousands in credit, your direct debit is probably set too high.

You can ask for a refund of most of the balance and adjust your direct debit to be lower. Be aware though, it is normal to be in credit this time of year because most households use less energy in the summer versus the winter when we have the heating on.

How hot do you need your water?

Heating water uses a lot of energy, so you can turn down the flow temperature of your boiler to shave a little off your bills.

As long as the water from your hot tap is comfortable to have a bath in, you don’t need to set it any hotter. You can do this manually or you may be able to ask a heating engineer to fit a device called a ‘weather compensator’.

Remember where warm air comes from

Keep radiators uncovered to maximise the benefit when they’re on. If you have long curtains covering your radiators, leave them open to make sure the warm air circulates into the room, not out of the window.

Look at the label

When shopping for a new appliance such as a washing machine or fridge, look at the efficiency ratings. If your budget can stretch to A or B-rated white goods, these can help lower your energy usage long term.

A version of this story was first published on February 25, 2025.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

An average family in Britain could be £1,400-a-year poorer by 2030, according to new analysis.

Frozen tax thresholds, rising mortgage and rent costs, and falling real earnings are all predicted to leave people worse off in the next five years.

The hardest blows will fall on the poorest third, who will bear the impact at twice the rate of middle and high earners, according to the analysis by thinktank The Joseph Rowntree Foundation (JRF).

The anti-poverty charity’s report predicts that the Labour government will miss one of its stated ‘milestones’ to raise living standards before the next election.

The £1,400 drop by April 2030 equates to a 3% fall in disposable income for the average family.

The lowest income households will be £900 per year worse off – a 6% fall, it said.

Average earnings are also set to fall by £700 per year by 2030, according to the JRF.

And the situation could be even worse for some as the analysis doesn’t account for the £5bn cut to disability benefits announced this week.

The charity used modelling forecasts from the Bank of England and others to create its prediction.

It also polled of 5,000 people with YouGov.

Alfie Stirling, its director of insight and policy, said Labour risks running the ‘first parliament on modern record to see a fall in average living standards from start to finish’.

It branded the welfare cuts ‘wrong’ and wants the plan scrapped.

Instead the government should instead raise cash by increasing tax on wealth and investments, it said.

This is unlikely to happen after by chancellor Rachel Reeves ruled out any more tax rises earlier this week.

When asked about the foundation’s findings, Reeves rejected the claims that living standards are falling.

She claimed that living standards in the last Consversative-run parliament ‘were the worst ever on record’.

The analysis came shortly before the chanellor’s spring statement in which more cuts are set to be announced in a bid to improve the country’s finances.

Today Reeves said the Civil Service’s administrative running costs will be slashed by 15% as part of her efficiency drive.

Whether this helps drive economic growth – the government’s top priority – remains to be seen.

The Bank of England recently halved its growth outlook for the UK economy this year to 0.75% – pouring more water on hopes of the economy reigniting after years of tepid growth.

There are also worries next month’s hike to employer national insurance and the minimum wage will create further drag on investment.

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.