5 May, 2025 | Admin | No Comments

ANC Gauteng bets on internal renewal to lift 2026 election prospects

The ANC in Gauteng believes it is on track to secure at least 40% of the vote in the 2026 local government elections, according to party insiders familiar with internal and external polling data.

The forecast emerged from a two-day weekend lekgotla in Fourways, Johannesburg, where the party’s provincial task team (PTT) met regional officials, members of the provincial legislature caucus, municipal representatives and national executive committee (NEC) members to craft a recovery plan for the embattled party.

A source who was part of the meeting told the Mail & Guardian that the research was conducted internally and externally and it showed that the ANC should grow in the upcoming elections.

“The external one, the settling is too little, ours is much broader, but I can say that even that 40% is almost like a lower estimate based on work not done. The elections will not necessarily be in 2026 it can even be in February 2027,” the source said.

“If we make sure that we implement all the programmes that we agreed upon, we up Ekurhuleni, we up Johannesburg and we lessen the tensions amongst members because elections that are ruptures are going to destroy us further. So even that 40% is going to improve dramatically.”

The ANC’s national support dropped significantly in the May 2024 general elections, getting just 36.49% of the vote — down from 50.19% in 2019.

The decline in Gauteng, the country’s most populous province and its economic engine, has sparked urgent efforts by the NEC to restructure its leadership and to reassert its political relevance.

The party dissolved its previous leadership and installed the PTT with a mandate to inspire hope, respond to electoral setbacks and accelerate transformation in line with its broader renewal agenda.

As part of the plan to exceed the projected 40% threshold, the ANC is prioritising stabilisation in key municipalities, particularly Tshwane.

“In my view, leaving it at 40% is correct but pushing it to 47% is what we need to do. There must be one or two metros which must be won,” the source said.

Another source told M&G that the report showed that the ANC would receive 40% in the elections but raised concerns about the party working with the Democratic Alliance (DA) and “the VAT matter”.

“We can’t be having the DA in the GNU, if we are to get support from the community. We know about these issues they are complaining about and this is what we must address. The polls say 40% but we still need to work hard.”

Responding to a question in a briefing after the PTT meeting on Sunday, co-convenor Panyaza Lesufi said the polling had caused excitement within the party.

“The issues of membership-buying and the issues of using money to influence the outcome, as this legotla and this PTT, it’s an area that we will prioritise so that we stamp out that kind of conduct and that kind of behaviour.

Lesufi’s co-convener Amos Masondo was more cautious, acknowledging the uncertainty of election outcomes but voicing confidence in the ANC’s ability to regain support.

“There is no way that the party could foretell the outcomes of the elections but, overall, the research and the kinds of discussion that the party has had, the ANC is confident that it would be able to turn back the wheel and have a positive outcome.”

The party is preparing to hold several regional conferences, with Johannesburg scheduled for June. However, Lesufi has warned against the use of these platforms for factional advantage.

Hope Papo, the party’s provincial coordinator, said that while conferences are a vital part of renewal, unity would not be sacrificed.

“If processes of the conference are used to further divide the organisation, the PTT will act on those activities,” Papo said. “We should not tolerate that kind of behaviour, whether by any branch leader, any member or any regional leader or any PTT member or any other member of the organisation.”

Papo emphasised the need for ethical leadership. “No weak organisation can serve diligently and fairly,” he said.

“The majority of ANC members are not delinquent and disruptors … the job of the PTT is to isolate those who are doing wrong things in the organisation to protect the rights of ANC members who, in the main, comply with what they are required to do as party members.”

Since GWM introduced it in 2021, the Haval Jolion has become the brand’s best-selling passenger vehicle in South Africa.

The Jolion became a talking point in the country as it offered consumers a great deal at an affordable price. South Africans love that and gobbled it up.

Haval then introduced the Jolion Pro in the last quarter of 2024. This one came with a much more sporty look. From an aggressive grille to a coupe-like silhouette, a rear spoiler, black door handles and a lightbar at the back, Haval took an already well-liked exterior and styled it to the maximum.

It really took the fight to the exterior of the Jetour Dashing and Baic Beijing X55, while maintaining its uniqueness.

You will also notice this is the first Haval vehicle that has GWM branding across the back as the Chinese manufacturer has opted to keep all its brands under the GWM umbrella, instead of its own brand.

The interior

The interior is very pleasing as well. When you get in, you are greeted by comfortable leather seats both in the front and back; a stylish leather dashboard with carbon-fibre print; a fully digital instrument cluster and a 12.3-inch infotainment screen that comes equipped with both Apple CarPlay and Android Auto.

The Jolion Pro also has a few buttons below the infotainment screen for aircon controls, park assist and the demister, which is extremely convenient.

Overall, the interior is lovely to look at and provides sufficient comfort for the driver and passengers.

Only the boot gave me issues with this car. First, the 291 litres of bootspace felt very cramped. Second, there was no electric tailgate which I thought was odd, especially in a car packed with so much technology.

The drive

The Jolion Pro, much like the classic Jolion, has a seven-speed, dual clutch transmission gearbox paired to a 1.5-litre turbocharged engine that delivers 105kW of power and 230Nm of torque.

I’ve never had a problem with the engines the majority of Chinese manufacturers put in compact SUVs. They provide sufficient power and a joyful and comfortable drive — albeit not the most seamless.

The other issue we’ve been finding with the 1.5 turbocharged vehicles which are paired to a DCT or CVT gearbox is that the fuel consumption is often far higher than the figure claimed by the manufacturer.

Luckily, this time, we were in the hybrid version of the Jolion Pro. It still has that 1.5-litre turbocharged engine but has an electric motor as well. The combined power of the two means increased performance and better fuel consumption.

The hybrid version is lightning quick and extremely silent. It is perfect for the urban areas or traffic where your battery kicks in to help save fuel.

Haval claims 5.1 litres/100km on the hybrid but a more realistic figure is 6 litres/100km.

Safety

The Haval Jolion Pro prioritises safety with features like adaptive cruise control, lane-keeping assist, blind-spot monitoring and a 360-degree camera system. The vehicle also benefits from a robust chassis, multiple airbags, ABS with EBD, electronic stability control and tyre-pressure monitoring.

Depending on which variant you jump into, you might be without features such as adaptive cruise control, lane-keep assist and a 360-degree camera. But, no matter which variant it is, the vehicle will be packed with technology and safety features to put you at ease.

The outer body of the vehicle feels solid and heavy. The robust frame and high-strength steel provide a strong foundation for safety.

Verdict

For all the technology packed into the Jolion, there was one thing that was slightly annoying. My late grandfather owned one of the first GWM bakkie models brought to South Africa and that bakkie and this Jolion Pro had the same hooter sound. I might be being picky here but the hooter does sound like it’s coming from an old vehicle.

With that said, aesthetically, the Jolion Pro is definitely an upgrade from the classic version. But, if we are talking about the drive quality, there is not much of a difference.

However, it must be noted that the classic Jolion did so well because of the amount of safety and technology that it gave consumers at an affordable price. The Pro does the same but looks cleaner. It ticks all the boxes and is still well worth it for South Africans on a budget who want a beautiful car that has everything.

The Jolion Pro comes in four variants: a premium (R391 150), super luxury (R425 950), ultra luxury (R462 950) and a HEV ultra luxury (R516 950).

From my experience, it is well worth going for the hybrid version if you can afford it. It provides a better drive and will save you money on running costs in the long run.

There has been a “remarkable and sustained disruption” in the trafficking of pangolin scales and ivory from Africa to Asia since the Covid-19 pandemic.

A new report from the Hague-based Wildlife Justice Commission documents a sharp decline in significant seizures since 2020, pointing to a shift in the criminal landscape and the potential long-term impact of targeted law-enforcement efforts.

It presents an updated analysis of ivory and pangolin scale trafficking trends over the past decade, comparing the pre-pandemic period from 2015 to 2019 with the post-pandemic period from 2020 to 2024. The report is based on reported seizure data, open-source research and criminal intelligence and investigation findings from the commission.

In 2019, pangolin scales and ivory were being trafficked from Africa to Asia in extraordinary quantities. During that year, two record-breaking pangolin scale shipments were seized just days apart in Singapore totaling more than 25 metric tonnes, while three ivory seizures were made in Vietnam, Singapore and China also amounting to more than 25 tonnes.

Rapid growth in the average shipment size pointed to the involvement of organised crime networks “operating at an industrial scale”. This was because of the significant financial capital, business infrastructure and corrupt connections required to move large shipments across continents with such frequency.

Then in 2020, triggered by the global shock of the Covid-19 pandemic, pangolin scale and ivory seizures plummeted — and have remained comparatively low in the years since. “The disruption was sudden and, remarkably, it appears to be holding.”

Apart from the effects of the pandemic, recent intelligence suggests that important law-enforcement efforts, fluctuations in price dynamics and changing market demands could be contributing to a substantial reduction in the illegal trade of both pangolin scales and ivory compared to the pre-Covid years, the report noted.

Since the disruption of the pandemic, there has been a substantial decrease in the number of multi-tonne seizures and a subsidence of the trend for combined shipments of both pangolin scales and ivory.

“While this could point to organised crime networks getting better at evading detection, fewer large consignments could also indicate a lower risk appetite for criminal networks to bear the financial losses caused in the event of law-enforcement interception,” it said.

There was also an increased proportion of multi-tonne seizures in Africa before export, which “could point to a greater proactive law-enforcement response in African hotspots”.

No significant pangolin scale seizures have been reported at any seaport globally for three years or airport for more than five years. “The relative absence of pangolin scale seizures at the demand side of the supply chain could suggest a diminished capacity of organised crime networks to move their goods out of Africa.”

While a shift appears to be emerging from Nigeria to other African countries for sending ivory shipments to Asia, persistent stockpile seizures in Nigeria suggest that it continues to be a key export hub for pangolin scale shipments.

“Criminal networks appear to adopt a fluid approach to commodity choice, diversifying their investments to take advantage of high demand and rising market prices of either product.”

The flexibility of networks to adapt to changes in the market and deal interchangeably with pangolin scales and ivory highlights the importance of targeting the criminal networks, rather than the product, to address this problem.

Pangolin scale values have declined and stabilised at lower levels at both the supply and demand ends of the supply chain. Ivory values declined by about half across the supply chain in the pre-pandemic period, then were relatively stable in Africa in the post-pandemic period.

“Steady product prices, alongside the ongoing but lower levels of product seizures, could point to continued existence of market demand for both commodities,” the report said.

Although the pandemic generated the initial shock, strengthened and targeted law-enforcement efforts could also have contributed to fundamental changes in the global wildlife crime landscape.

“The current intelligence picture suggests a major reduction in the trafficking of both commodities, which appears to have stabilised at relatively low levels compared to the pre-pandemic period.

“However, intelligence gaps remain on the extent to which pangolin scale and ivory shipments are successfully entering supply chains in Asia, despite the apparent slowing down of seizures.

The report found that the impact of the Covid-19 pandemic on the trafficking of pangolin scales and ivory from Africa to Asia “cannot be overstated”.

“It wreaked havoc on the transcontinental wildlife supply chains and upended the unsustainable trajectory of the trafficking of these commodities.”

The commission said that the current intelligence picture suggests a major reduction in the trafficking of both commodities, which appears to have stabilised at relatively low levels compared to the pre-pandemic period.

“Key questions include whether shipments are no longer being detected due to the use of more sophisticated concealment methodologies or changed modus operandi, or whether networks have procured better corruption settings at the receiver ports to facilitate more secure importation of goods.”

Limited data on pangolin population levels also means the possibility of a scarcity of product contributing to the drop in transnational trade “cannot be ruled out”, although the ongoing large stockpile seizures in Africa and steady pricing trends suggest this is unlikely to be the case just yet.

“While the root causes of the disruption in the trafficking landscape are likely varied and complex, investigation findings indicate that proactive law enforcement efforts targeting the primary criminal networks in African hotspots with arrests and prosecutions are having an important impact.

“Intelligence from Wildlife Justice Commission investigations has found that fear and breakdown in trust among the networks at the supply side is resulting in an increased perception of risk and a stalemate scenario between wholesale suppliers, Asian buyers, and brokers that is thwarting their ability to do business.”

Law-enforcement results achieved by Chinese and Nigerian authorities have had a “highly disruptive impact” on the criminal landscape in a relatively short period of time, underlining the effectiveness of a consistent and targeted criminal justice approach, the report said.

Among the report’s recommendations are a top-tier targeting strategy to map the criminal networks and identify and target the crime bosses, financiers and high-value linchpins who play a crucial role in the network’s activities.

Further recommendations include deepening long-term, intelligence-led investigations to penetrate complex networks, corroborate intelligence and gather robust evidence and to target the profits of crime through financial investigations and asset forfeiture.

There should be joint investigations and intelligence sharing as they are essential to dismantle networks operating across multiple countries, it said.

1 May, 2025 | Admin | No Comments

‘Cash is king’: UK shoppers fume over businesses that only accept card payment

When Covid forced the high street to go digital and turned handling physical money into a health risk, some businesses decided to stop accepting cash altogether.

As a result, cash use fell by 35% in 2020 alone, the steepest drop in a years-long downward trajectory.

Just 12% of all payments were made using cash in 2023, a figure that sat at 51% a decade earlier – and nowadays, ‘card only’ signs are a common sight.

But while many prefer the ease of contactless shopping, the Treasury Committee has warned that this trend could lead to a ‘two-tier society’ where vulnerable people are left behind.

According to its latest report, elderly people, disabled people, domestic abuse victims and those on low incomes are at risk of being excluded if the country transitions to a cashless economy.

Reduced consumer choice and ability to budget were also listed as potential impacts, with LINK research showing that half of respondents had been somewhere that did not accept or discouraged cash payments over the previous eight weeks.

While it stopped short of recommending a change in the law, it said ‘there may come a time in the future’ where cash acceptance is mandated, ‘if appropriate safeguards have not been implemented for those who need physical cash.’

Committee chair, Dame Meg Hillier, commented: ‘The Government is in the dark on how widely cash is being accepted and that is completely unsustainable… this needs to be a wake-up call.’

Metro readers thoughts on going cashless

On Facebook, Metro readers shared a number of concerns over the possibility of a cashless future, including Natalie Carter who commented: ‘Everyone loves cards, until there is a blackout or the banking apps go down. Then everyone cries about not being to pay bills. I say stick with cash – it can’t be manipulated the way digital can.’

‘Cash all the way, if you don’t use it you lose it,’ added Dawn Hughson, whileAlly wrote: ‘Cash is king! I always pay in cash.’

When it comes to shared the places where ‘card only’ policies irk them most, car parks were a common theme.

Sharon Woodward was among those who bemoaned trying to pay for parking with no signal and dodgy apps or card machines that time themselves out.

Lorraine Close said she’d ‘hate to be stuck to using card only at the pub’ as ‘it’s impossible to over spend if you take your limit in cash’, while according to Lorraine Stocks, the ability to pay with cash at Center Parcs would help it be ‘an inclusive place for everyone’.

Jo Sturch said she’s decided to boycott Gail’s for her coffees after forgetting they don’t take cash, but Kristen Stephanie Roobottom claims it’s most annoying at theme parks ‘when you have little ones with pennies to spend on a treat’ since ‘it doesn’t feel the same with pocket money just paying on a card.’

Cashless refreshments trolleys on planes were another common gripe, with Barbara Ibbett claiming her Barclays bank cards ‘don’t seem to work on EasyJet, leaving her without an in-flight snack.

Is it legal for retailers to refuse cash?

Although cash is considered ‘legal tender’, this only means it can’t be refused as payment for a court-ordered debt.

The Treasury explains: ‘The acceptance of physical currency in the UK is not currently specified in legislation. Businesses and organisations can therefore choose which payment methods they accept.’

If a retailer specifies card payment only and you’d prefer to use cash, unfortunately your only option at present is to take your business elsewhere.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

An iconic pottery firm has gone bust after more than 100 years of trading.

Moorcroft Pottery, based in Stoke-on-Trent at the heart of the UK’s pottery region, has shut with immediate effect, putting 57 people out of work.

Directors had warned of job cuts in March and worked to find a buyer in the weeks leading to the closure.

Bosses said in a statement: ‘The company faces an increase in energy and other costs, in a difficult trading environment with a global cost of living crisis. This has resulted in a seemingly unsustainable financial position.

‘The board of directors wishes to thank each employee for their unique heritage skills and commitment to the art pottery during a very challenging economic period.

‘The directors have pursued every avenue possible to save the business, however they have been left with no other option than to engage the services of a local insolvency firm to place the company into liquidation.’

Union organiser Chris Hoof told Metro: ‘The closure of Moorcroft is devastating news for workers and their families, but, unfortunately, it’s not a surprise.

‘The government must act and act now to support the ceramics sector and protect workers in this sector.’

Moorcroft was founded in 1897 and by 1928 it was appointed as Potter to HM The Queen during the reign of George V and Mary.

Queen Elizabeth II added Moorcroft designs into the Royal Collection and the company won many prestigious international awards.

Reflecting on the collapse of Moorcroft, a spokesman from the British Ceramic Confederation said: ‘This regrettable news underscores the significant challenges currently facing the UK ceramics sector, including soaring energy costs, increased international competition, and a difficult trading environment.

‘These pressures are making it increasingly difficult for even established and celebrated manufacturers to remain viable.

‘Ceramics UK is actively engaging with the government and relevant stakeholders to highlight the urgent need for support for our vital industry.’

Rise and fall of an industry

The pottery industry in Stoke traces its roots back to the mid-17th century, thanks to an abundance of clay.

There was a boom in the yearly 1700s and by World War Two, half the town’s population was employed in the industry.

However, over recent decades, there has been significant decline with the closures of Dudson in 2019, Wade in 2023, Johnsons Tiles in 2024, and Royal Stafford in February.

The collapse of the industry has been put down to:

- the rise of mass production

- not enough people with the right skills

- Lack of support for small business

Despite the bleak outlook for the industry, Stoke-on-Trent retains its status as the World Capital of Ceramics.

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.

30 Apr, 2025 | Admin | No Comments

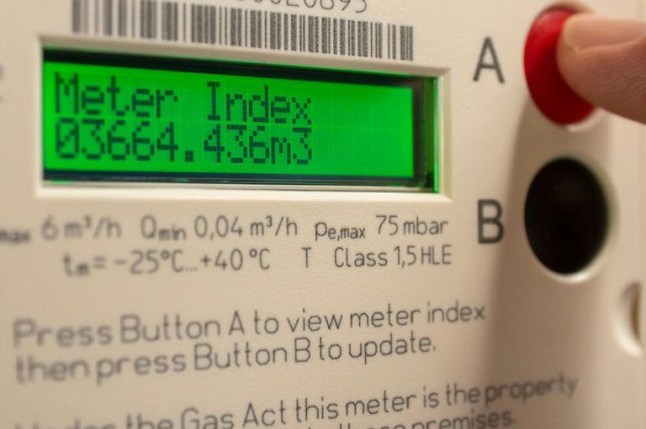

Electric meters are changing – here’s how it affects you and what you need to do

Hundreds of thousands of people could be left with no heating or hot water as their obsolete electricity meters are shut down.

Radio Teleswitching Systems (RTS) are being switched off for good on June 30 – but energy companies warn it will be ‘very very difficult’ to replace all of them with smart meters before that deadline.

By the end of March there were still 430,000 homes using RTS meters for their heating and hot water, and campaigners reckon more than 300,000 will still be stuck with the old tech when it’s switched off.

Energy UK, which represents energy companies, says more than 1,000 RTS meters are being replaced each day – but in order to reach everyone in time they would need to replace closer to 5,000 per day.

And not only could homes be left with no heating or hot water, there are also concerns they could be stuck with their heating constantly on during the warmer summer months.

Ofgem, the energy regulator, has called it an ‘urgent consumer welfare issue’ while the government said the industry has to ‘work urgently to continue to increase the pace of replacements’.

When asked if it was impossible to switch every meter by the June 30 deadline, Ned Hammond, Energy UK’s deputy director for customers, told the BBC: ‘I wouldn’t want to say impossible – but clearly very, very difficult to get to that point.’

RTS meters have been used since the 1980s, using a longwave radio frequency to switch between peak and off peak rates.

They tend to control heating and hot water on a separate circuit to the rest of the household’s electrics, meaning plug sockets and lights are unlikely to be impacted by the switch-off.

The deadline for the switch-off was originally set for March 2024, but it was extended by more than a year to give energy companies more time.

How do I know if I have an RTS meter?

According to the Energy Saving Trust, you might have an RTS meter if you:

- Live in a house with no gas connection

- Use electric heating to heat your home

- Have a tariff where the price of electricity changes at different times of day

- Have a separate box near your electricity meter with the words ‘radio teleswitch’ or ‘radio telemeter

- You have two codes on your electricity bill that start with the letter S. These are ‘supply numbers’ or ‘S numbers’

What happens if my RTS meter isn’t changed by the deadline?

If your supplier doesn’t replace your meter by June 30, your heating and hot water will likely be affected. They might:

- Stay on all the time

- Not come on at all

- Charge at the wrong time of day

- Turn on and off at odd times of day

- Not come on when you want them to

You might see your energy bills go up as a result.

Ned said energy companies are still aiming for the June 30 deadline ‘as things stand’, and say they are developing plans for a ‘managed and very careful phase down of the system’ to try and protect vulnerable customers.

Simon Francis, from the End Fuel Poverty Coalition, said: ‘With pressures on the replacement programme growing and with limited engineer availability, especially in rural areas, there’s a real risk of prolonged disruption, particularly for vulnerable households.’

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.

Having gained over 107,000 signatures, Metro and the family support charity Feed delivered their Formula for Change petition to the Prime Minister Keir Starmer and Secretary of State for Health and Social Care Wes Streeting today, to demand more is done to make infant formula accessible and affordable to all families.

Launched in 2023, our award-winning campaign has continued to raise awareness of the impact of soaring formula prices, which have rocketed by 25% in the past two years.

Under current guidelines, formula falls into the same category as tobacco and lottery items, and isn’t available to purchase with cash alternatives. However, without loyalty points and grocery vouchers provided by local councils and food banks to those struggling the most, parents at the sharpest end of the cost-of-living crisis have few options.

Some families are even being forced into unsafe infant feeding practices that put their babies’ health at risk, while others are formula foraging, or stealing formula to feed their children.

This is why the Formula for Change petition is urgently calling on the UK Government to review infant formula legislation and give retailers a clear green light to accept loyalty points, grocery vouchers provided by food banks and local authorities, and store gift cards as payment for infant formula.

While we know this measure alone won’t solve the problem, it will increase options for families.

To view this video please enable JavaScript, and consider upgrading to a web

browser that

supports HTML5

video

The Westminster visit follows the Competition and Markets Authority’s recommendations that vouchers and loyalty points should be allowed when buying infant formula.Despite the CMA’s suggestion, the government has yet to comment on the issue.

When a petition exceeds 100,000, it is considered for debate in Parliament, and today’s milestone achievement saw key figures in the campaign’s success visit No.10 to hand-deliver the document.

Metro deputy editor Claie Wilson, journalist Kat Romero and founder of Feed Dr Erin Williams headed to No. 10 with Blackpool South MP Chris Webb and celebrity supporters LadBaby’s Mark Hoyle and wife Roxanne, who have been instrumental in the campaign by garnering support across their social media platforms and sharing their own experiences of food poverty.

Outside No. 10, Mark told Metro: ‘We’re hoping this is going to make such a huge difference to so many families in the UK.’

Roxanne added: ‘We wanted to be involved in the campaign because Mark and I meet parents who have cried at the checkout because they haven’t been able to use their vouchers to get formula.

‘It’s really important we’re not judging families. Every baby deserves to be fed.’

Metro’s Claie said: ‘I am so proud of the work we have done to raise awareness of the formula crisis in the UK and also so pleased to see so many others share their support and help make change.

‘Now we just need the government to do their bit. Last year, Wes Streeting promised to “get it done”, yet we’re still waiting, and families are still struggling. It is time to follow through on their pledge to help formula feeding parents.’

Kat said: ‘Over two years ago, I pitched a feature to Claie about a government policy that prohibited the discount of infant formula and how it was impacting families in a cost-of-living crisis.

‘Through that piece, I met Erin and the idea to launch this as a campaign was born. In the two years since, Formula For Change has achieved more than any of us involved could have imagined and today, we were invited to Downing Street to formally deliver our petition of over 100,000 signatures. Change is coming. What a day.’

Erin expressed how proud she was of how far the campaign has come in two years, but also admitted that there was still work to be done. Desperate parents have been reduced to watering down formula and even stealing tubs off shop shelves to ensure their babies get fed.

‘We’ve had great success in bringing down the prices of formula across the board, so families can still feed their children when money is tight,’ Erin told Metro.

‘We’re under no illusion that this will solve all the problems, but little actions can have big consequences.

‘We don’t need to change any laws or have big debates; change can be done without that, and it can be done quickly.’

Chris also joined the campaign team to deliver the petition, after recently raising the issue in the House of Commons and holding a drop-in event at Westminster to highlight the campaign to fellow MPs.

He said: ‘Today really puts into focus how much support this campaign has gathered across the UK, from normal working-class people to celebrities. It’s great to be able to hand that over to make sure their voices are all heard.’

Speaking about his personal reason for wanting to be involved, Chris explained: ‘When I had my son last year, I went to baby groups. I saw mums struggling, asking for tubs of formula, and the same at food banks.There are babies that are going hungry. Families need help.

‘I looked for campaigns that were trying to provide this, and I found Formula for Change, so I reached out and have done what I can from my part.

‘We’re heading in the right direction and we won’t stop until formula is accessible to all.’

Further Formula For Change supporters came to Parliament Square to share the moment, including director Naomi Waring, whose short film about the formula crisis, Milk, was produced by Sienna Miller. Founders of baby banks The Space, Little Village and Abernecessities, and Change Box also attended.

Since its launch, there have been many wins for the Formula for Change campaign. Iceland was the first high street retailer to allow loyalty vouchers and gift cards to purchase baby formula. They also took the lead in providing clear labelling on baby formula to inform parents that all first infant formulas are nutritionally equivalent, regardless of brand or price.

Richard Walker, Executive Chairman of Iceland Foods said: ‘Formula for Change truly is a life-changing campaign for thousands of parents, and I’ve been so proud that we have supported its efforts as a business.

‘The work conducted by the team at Metro and Feed has been astonishing, and I fully support the petition they have delivered to No.10 today. It’s vital that the Government supports the CMA’s recommendations so we can make the formula affordable and accessible for all.’

Morrison’s has also gone on to allow other forms of payment for infant formula, while the Department of Health and Social Care officially confirmed that food and baby banks can supply cash-strapped families with formula tubs.

Since 2023, the campaign has received the backing of several MPs, including Monica Lennon, Preet Kaur Gill and celebrities Katherine Ryan, Ashley James and Michelle Heaton are among the famous faces who have voiced their support.

The campaign has also been given the prestigious Making a Difference award, which was voted for by the public, acknowledging Formula For Change’s drive for change.

Do you have a story you’d like to share? Get in touch by emailing Josie.Copson@metro.co.uk

Share your views in the comments below.

If there’s one thing I know to be true about Lidl, it’s that the supermarket’s in-store bakery has a cult following.

Seriously, people are obsessed with everything from the retailer’s All Butter Croissant – with 122 of them selling every single minute – to the chocolate twists and the bread.

And there’s good news if you are part of the fan club, as it’s just been announced that Lidl is slicing its bakery prices, with some items now selling for just 29p each.

Customers will be able to purchase a Petit Pain or White Crusty Roll for 29p (previously 32p), while the beloved croissant will be going from 65p to 59p.

Other items included in the price drop are the All Butter Pain Au Chocolate, Pain Aux Raisin, Chocolate Twist, Chocolate Hazelnut Croissant, Almond Croissant, Maple and Pecan Plait and the Pastel de Nata.

All of these baked goods were originally 79p, but will have a new price of 69p.

A new Apple Turnover is also going to be just 69p when it launches in-store on April 25.

It’s not clear how long this roll back of prices will last for, so if you’re a pastry lover you might want to enjoy the savings while you can.

This comes after Lidl launched several new bakery items over Easter, including a Mini Egg Brownie, Cinnamon Bun Blondie, and a Brioche Chocolate Croissant.

And the retailer also recently unveiled plans for its first-ever in-store supermarket pub.

The £410,000 boozer will be located in a store in Dundonald, just outside Belfast, on the left side of the existing supermarket, at the opposite end of the store from the entrance.

According to drawings submitted to local planning officials, there will be six seats around the main bar, with 10 other tables/seating areas dotted around inside.

A lobby area, keg room, storage space with an ice machine, chill store, and office, with three toilets – a customer WC, an accessible unisex toilet and one for staff use only – are planned too.

The pub will also have an ‘off-sales’ area where customers can buy alcohol to consume off the premises, and an entrance/exit leading to the car park.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

24 Apr, 2025 | Admin | No Comments

Nationwide shares major update on £100 customer bonus payout date

If you bank with Nationwide, you could be due a windfall in the next few months — a welcome prospect for those in need of a cash boost.

The building society operates as a mutual rather than a traditional bank, meaning it’s owned by and run for the benefit of its members.

As such, Nationwide shares profits among account holders (rather than shareholders) as part of its Fairer Share Payment initiative, with almost 4 million customers nabbing a £100 bonus last summer.

‘The Fairer Share Payment is our way of rewarding those members who choose us for their everyday banking as well as having savings or a mortgage with us,’ the bank said in a statement.

The exact details of Nationwide’s next one-off payout have yet to be revealed, but recently announcement offers a major update on the timeline.

And ahead of the Board’s official decision, last year’s eligibility criteria gives us an idea of what to expect this time around.

When will the Nationwide bonus be paid out?

The bank’s financial results are due to be shared with the public on Thursday May 29, along with an announcement on the Fairer Share Payment.

A Nationwide spokesperson tells Metro: ‘Nationwide’s Board will decide on a Fairer Share payment for 2025 and it will depend on our financial performance.

‘That assessment will be made after our financial year end, with the eligibility criteria for this year being agreed then too. The decision will be announced as part of our full year results in May.’

Last year, bonuses were deposited into members’ accounts between June 13 and June 28, so if the scheme does go ahead – which Martin Lewis’s Money Saving Expert said is a ‘likely’ outcome – you’ll probably have a few months to wait before you receive any cash.

However, all the hard work was done for customers in previous payouts, so you shouldn’t need to make a claim or request the money yourself.

If it’s confirmed and you think you qualify but haven’t heard anything from Nationwide by June, get in touch. And don’t forget to stay aware of fraudulent attempts at obtaining your personal information to apply for the payment.

Who is eligible for the Nationwide bonus?

Assuming the scheme comes with the same prerequisites as it did for 2023-2024, to be in the running, customers must hold both a qualifying current account as well as a qualifying savings or mortgage account.

Each of the bank’s current accounts were eligible, providing certain criteria are met.

The first of these is that the account was open on March 31, the end of the financial year — although those who switched accounts between January 1 and March 31 were exempt from any additional requirements.

Otherwise, Nationwide explained that FlexAccount, FlexDirect or FlexBasic holders must have either received £500, made two payments from their account, or completed at least 10 payments out of the account between January and March to qualify.

Meanwhile, FlexPlus account holders must have paid their monthly fee, and FlexOne, FlexStudent or FlexGraduate customers need to have made at least one payment in or out during March.

Those with investment accounts and stocks and shares weren’t included in the criteria, but savings account holders qualified if they had a minimum of £100 in total across Nationwide personal savings accounts or cash ISAs at the end of any day in March.

When it came to mortgages, customers must have owed at least £100 on their residential mortgage with the building society on March 31.

Home loans through subsidiaries such as The Mortgage Works, UCB Home Loans Corporation Limited, or Derbyshire Home Loans Limited are excluded from the bonus, as are commercial mortgages and those not completed by March 31.

If you’re not sure whether you fit the bill, you can use Nationwide’s eligibility checker to work it out (although be aware this criteria may change for 2025).

A version of this article was first published on December 12, 2024.

Do you have a story to share?

Get in touch by emailing MetroLifestyleTeam@Metro.co.uk.

22 Apr, 2025 | Admin | No Comments

Mum-of-two took own life ‘after mortgage payments shot up by £500 a month’

A mum-of-two killed herself after her mortgage payments rose by £500 a month and her application for benefits was turned down, her daughter has said.

Kathleen Moore, 60, spent the last four years struggling to make her payments after they shot up due to rising interest rates on her interest only loan.

She had osteoporosis, which hindered how much she could work as a dog sitter, and she was too young to retire and receive her pension.

Kathleen applied for personal independence payment (PIP) and universal credit but was told she didn’t meet the criteria due to her age and the fact she had a mortgage.

Daughter Amy Evans, 37, said her mum tried to work at least 30 hours a month and rented out rooms in her home to try and make the mortgage payments but still had to rely on foodbanks.

Amy said her mum would often talk about was her money problems but didn’t let on how bad it was.

She said she was ‘devastated’ when she got the call to say she had taken her own life in August 2024.

Now she is petitioning to see more financial and mental health support for those over 60 – including a review into the eligibility criteria for Universal Credit and PIP.

Amy, a cleaner, from Lowestoft, Suffolk, said: ‘She’d talk about money so much.

‘It consumed her – the worry – for such a resilient person.

‘She wasn’t entitled to universal credit because she had a mortgage. She wasn’t poorly enough for PIP. Everywhere she turned there were no answers.

‘If someone had helped – she’d still be here.’

Amy said she noticed her mum started stressing about money after becoming single four years ago.

She said: ‘She was with her partner for 10 years and they went their separate ways. It made it difficult for my mum financially.

‘The interest rates went up. I think her mortgage went up from £100 to £600-a-month.’

Amy said she offered to let her mum stay with her if she needed to, but described how she was ‘proud’ and wanted to stay in her own home.

Amy said: ‘It took a lot for her to ask for help – I think she was ashamed.’

She said the family did not realise how bad things were because whenever things seemed to ‘dip’ she always appeared to ‘get back on her feet’.

That realisation came crashing down when Amy got the call on August 15 last year to say her mum had ended her life.

Amy said: ‘It wasn’t really until she’d gone that we looked at all the paperwork and saw how desperate she’d become.

‘She could never really make ends meet. She got desperate and bought into loan sharks. She was so worried all the time about having a roof over her head.’

Now Amy is calling for a review into the eligibility criteria for universal credit and personal independence payment (PIP) to ensure individuals aged 60 and over who are self-employed, carers, or single without dependents are no longer ‘unfairly’ excluded from vital financial support.

She also wants to see a dedicated mental health counselling service for those aged 60 and over.

Amy said: ‘She needed a financial solution. Someone to talk to could have changed what she was planning.’

Paying tribute to her mum, she recalled how she ‘was the life and soul of most parties when she was younger’ and ‘was very resilient’.

‘I hope the petition will save someone else,’ she added.

Amy’s petition can be found here.

Need support?

For emotional support, you can call the Samaritans 24-hour helpline on 116 123, email jo@samaritans.org, visit a Samaritans branch in person or go to the Samaritans website.

Their HOPELINE247 is open every day of the year, 24 hours a day. You can call 0800 068 4141, text 88247 or email: pat@papyrus-uk.org.

Get in touch with our news team by emailing us at webnews@metro.co.uk.

For more stories like this, check our news page.